Observing Ethereum Governance during the ProgPoW debate

The trends, patterns and arguments the author has observed during the ProgPoW debate, appear to have thinkers converging on many solutions Decred has elegantly solved in its own bubble.

Ethereum is currently deep in the negotiation process with respect to implementing the ProgPoW mining algorithm change. This has undoubtedly become a contentious issue with the community rising against the core developers, whom they feel ‘ninja-approved’ the ProgPoW EIP in a recent conference call. Given this EIP was assumed to have gone cold, this has sparked heated discussion and has been a valuable test of the Ethereum governance structure.

The author’s read on the situation, is that the ProgPoW debate has largely converged onto discussing the Ethereum power structure, more-so than the technical merits of ProgPoW. In many ways, this debate has similarities to the Bitcoin scaling/SegWit war which carried on for many years and eventually became more about who truly controls Bitcoin; users, miners, developers or economic nodes; than the technical merits of SegWit.

This is a good thing.

As Spencer Noon identifies, this is a sign of Ethereum maturing and reaching a stage in life where a $30B network is on the line. Over $1B of this is bound in leveraged, price sensitive ‘DeFi’ applications and significant parallel value is reliant on primitives, protocols and people.

Scott Lewis rightly points out that this is not going to be the last time a contentious and dangerous fork discussion comes up. If all things go as planned, next time there may well be $300B on the line, making it all the more important to reach reliable consensus before upgrading into a potential chain split.

Why write this note?

This high level note comes from an outsider who considers himself relatively informed on blockchain mechanics and who has experience from within the Decred project. The intent of the opinion is simply to provide a constructive opinion based on the author’s lessons learned from actively participating in the Decred governance process.

After observing the Ethereum community problem solving in public during the ProgPoW debate, it has become apparent that many thought leaders are ‘live hashing out’ the Decred model. The ‘wish list’ is quickly converging to a system requiring:

- Non-gameable counts of consensus opinion

- Requirement for skin-in-the game to have a meaningful say

- Ability to achieve upgrade by consensus, as the Bitcoin model of consensus by upgrade risks a destructive chain split, and is largely unacceptable in a landscape of DeFi.

In fact, the true inspiration for this piece comes from seeing Ameen and MolochDAO’s responses, suggesting a system of coordination is required, with skin-in-the-game behind each signal, something which could be achieved with an unforgeable on-chain vote (and not necessarily at the L1 layer). The author believes this is extremely powerful and agrees wholeheartedly.

Goals of the author

The author does not intend to tell Ethereum how to govern itself, suck eggs nor undermine the rough consensus model it has adopted. Instead, the intent is to highlight where the Ethereum community may benefit from tools and principles of governance pioneered and developed by Decred.

From the Decred constitution, the first three principles are directly relevant to the discussion.

Free and Open-Source Software — All software developed as part of Decred shall be free and open source-software.

Free Speech and Consideration — Everyone has the right to communicate opinions and ideas without fear of censorship. Consideration shall be given to all constructive speech that is based in fact and reason.

Multi-Stakeholder Inclusivity — Inclusivity represents a multi-stakeholder system and an active effort shall be maintained to include a diverse set of views and users.

These procedures underpin an efficient and decisive social coordination mechanism. They act in unison to give the wider community a meaningful say within the constraints provided by distributed ledger technology.

At the end of the day, if Ethereum can implement a suite of tools that facilitates better coordination around ‘contentious’ fork proposals, it will essentially nullify the supposed ‘advantages’ of its most viable competitor, Tezos.

A combination of off-chain and on-chain governance fits with the Ethereum social contract and path towards innovation and DAOs. Ultimately, the Decred DAO has already written much of the initial code and tested the implementation in production for years which hopefully de-risks the en-devour for others.

The ideal outcome, is that this discussion provides a springboard for new ideas, coordination tools and processes for managing future contentious forks safely.

The solution hopefully makes James Hancock’s job just that little bit easier and much less stressful (by automating most of it away).

Observations of Governance

The following sections will discuss tweets and ideas observed in the wild. Cases where Ethereum community members have proposed ‘I wish Ethereum had X’ with respect to social coordination. On aggregate, the community is gradually converging on the key elements which make Decred’s governance model so powerful.

It is important to keep in mind that Decred’s governance model is as much about the off-chain social contract as it is about technical on-chain and hard fork capacity. Decred opts to provide transparent and universal rules of engagement and builds the tools to facilitate the discussion.

These principles are applicable to any blockchain governance model, perhaps with the exception of Bitcoin.

1. Measuring Consensus

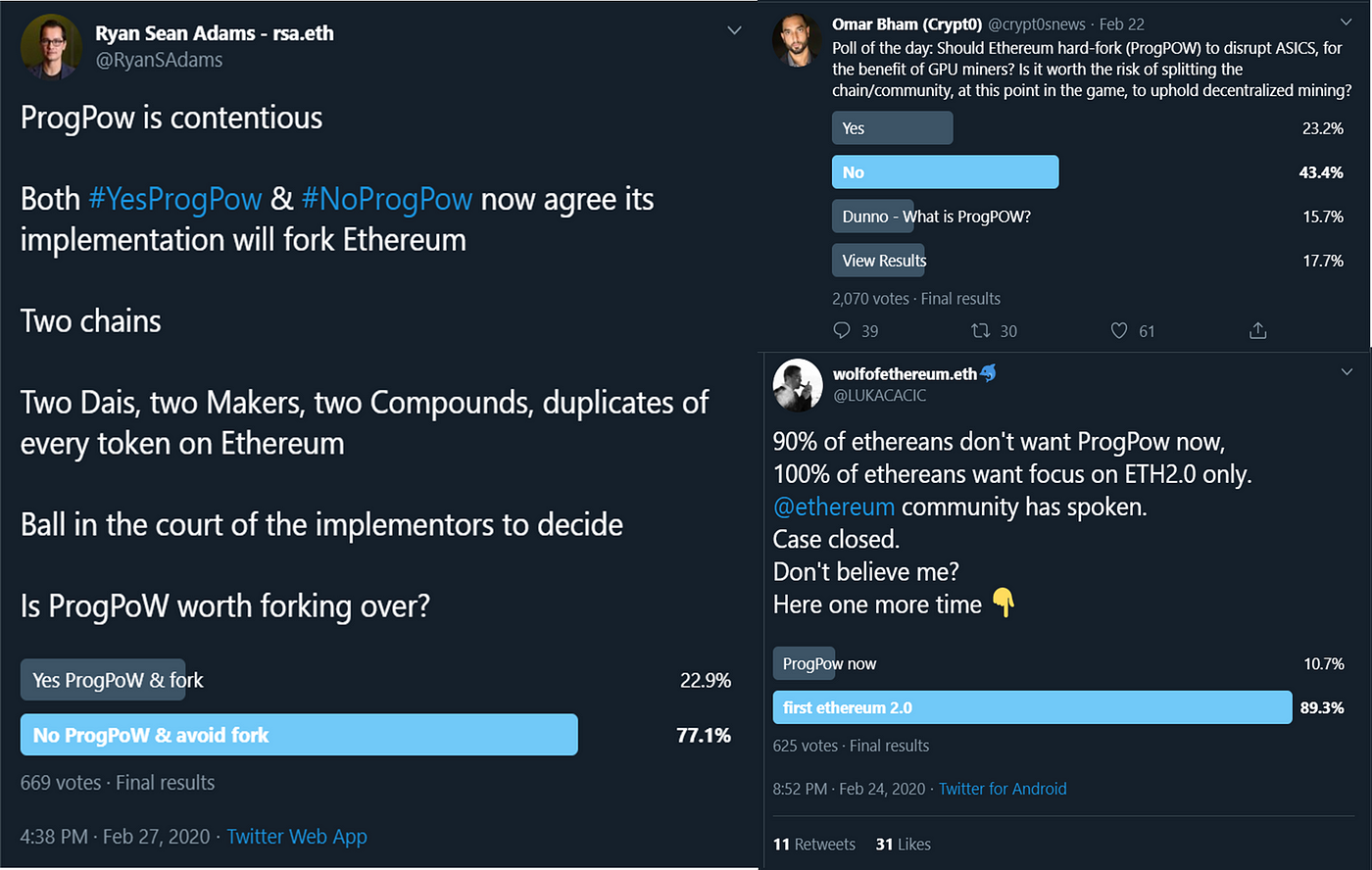

Twitter polls are not effective nor are closed circle conference calls. The latter is in fact destructive as it undermines community trust that their say has any weight over the core developers, with ProgPoW as the latest example.

People can answer a twitter poll without owning a single Ethereum token. In fact, what would happen if you found out that a dominant majority of votes came from the EOS, Tezos or Bitcoin crowd looking purely to undermine your statistics?

It is in their best interest to do so.

I am positive that the Ethereum community is far larger than 625 to 2070 people and I am also positive that the number of people who would actively seek to undermine it is even larger.

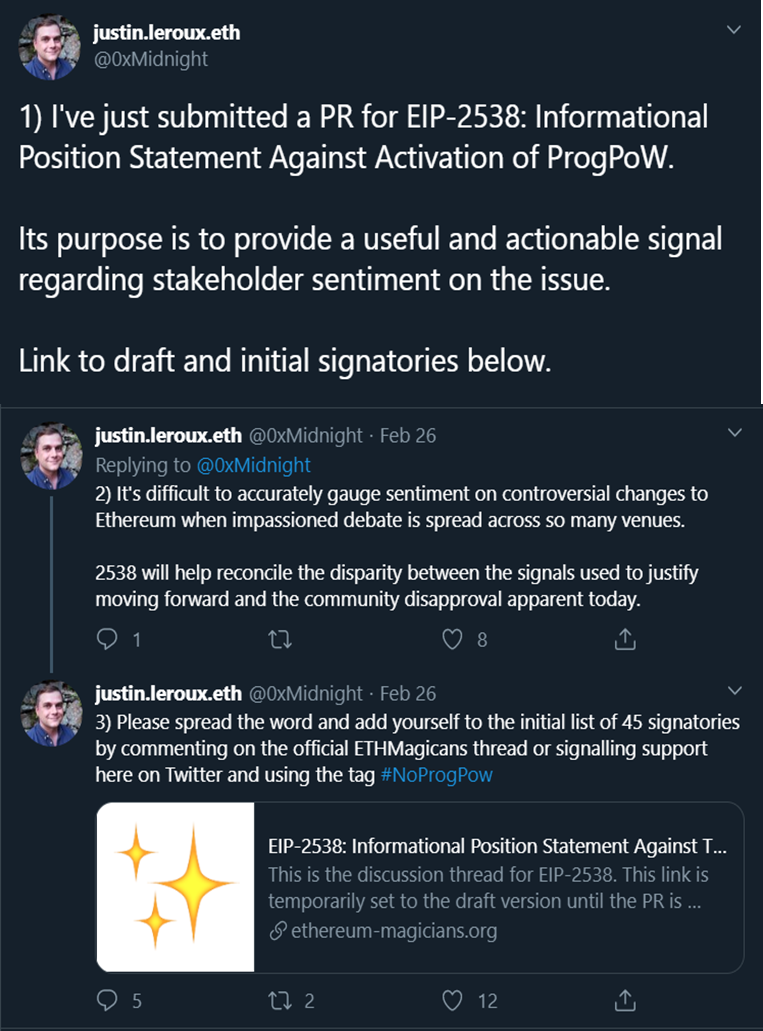

The strongest approach so far has been the issuance of EIP-2538 which amounts to a signed petition by many of the leading product developers and community influencers. This counter-proposal to ProgPoW (EIP-1057) makes the opposition formal and certainly makes ProgPoW undeniably contentious.

Should the developers and miners collude and push through ProgPoW, it would most likely result in a chain split and a breakdown in trust and reliability of the current governance model. This is clearly an undesirable outcome.

Where this EIP process could be complimented is by inclusion of unforgeable signatures, perhaps with economic weight behind them. The MolochDAO signature can have a verifiable hash with some volume of ETH (some hashed state root) for and against the change.

The list of pseudonymous signers is a positive step for privacy preservation (the author himself is pseudonymous) however, the system is easily gamed, and needs some cryptographic AND behavioral proof that each entity exists.

Pseudonymous accounts represent a large portion of the Decred DAO and these folks have to gradually built trust in the community based their merits and delivery. Once this trust is gained, communications can be readily verified by their Politeia identity and cryptographic signature.

2. Clarity in the Rules and Education

A feature of the ProgPoW debate which stands out, is that very few discussions centre on whether the project actually needs it. Many seem to be lacking a sound understanding of the technical or game theoretic issues at hand and few seem to discuss the merits of the change on either side of the debate.

Some attempts have been made to aggregate for/against, however, conversations on Twitter still tend to devolve into a yelling match with a relative lack of appreciation for what ProgPoW actually means for the blockchain long term.

A key benefit of Politeia as an off-chain governance system is that it is a process, and one which has clearly defined rules of engagement. People know the drill and how to actively participate. The rules of Decreds governance are explicitwhich means that even if an issue is contentious, the pathway towards a decision is crystal clear (the decision can be to uphold the status-quo).

This process is supplemented by the monthly Decred Journal and Decred in Depth podcast targeting stakeholder education. Both of these media provide stakeholders a means to track progress and learn the distilled details of each change, from the source, long before it hits the point of contention.

Generally speaking, a sub-set of the Decred community are regular participants in governance, however, occasionally both new and old voices (re)emerge, especially for contentious issues. This suggests they are still keeping abreast of the issues and jump in when their opinion has not been adequately captured by others. The author sees numerous parallels with the EIP-2538 signatories.

Keep people well informed, incentivised and provide the tools to actively participate. To align the game theory, participation must require participants putting their savings on the line (skin-in-the-game), making for sounder and risk minimised decisions.

The author is not ignorant of the fact Decred is a small network relative to Ethereum and there are challenges that come with scale. At the end of the day, it is the social contract of the network that needs to scale, which is true for all distributed ledgers.

Education, clear rules of engagement and humans acting in their own best interest, in the authors opinion, scales very well.

By contrast, opaque governance and rough consensus, whilst a feature in many regards, most certainly leads to toxic, unproductive debates which distract from the problem at hand. Don’t let toxicity become Ethereum’s governance mechanism (the author suggests reading the linked essay, it is one of their favorites).

3. Skin-in-the-game

- A Bitcoiner with nothing but an ETHBTC short in their portfolio really should have near zero say in Ethereum governance.

- A casual ETH holder should have a mechanism to have some say, but are most powerful as a collective where a quantity of signatures has more meaning.

- The crews over at MolochDAO, Maker and Compound are heavy hitters. They are cornerstones of DeFi, support massive investments, and control vast user assets under management. Their say should be reasonably magnified to provide the community a guiding position.

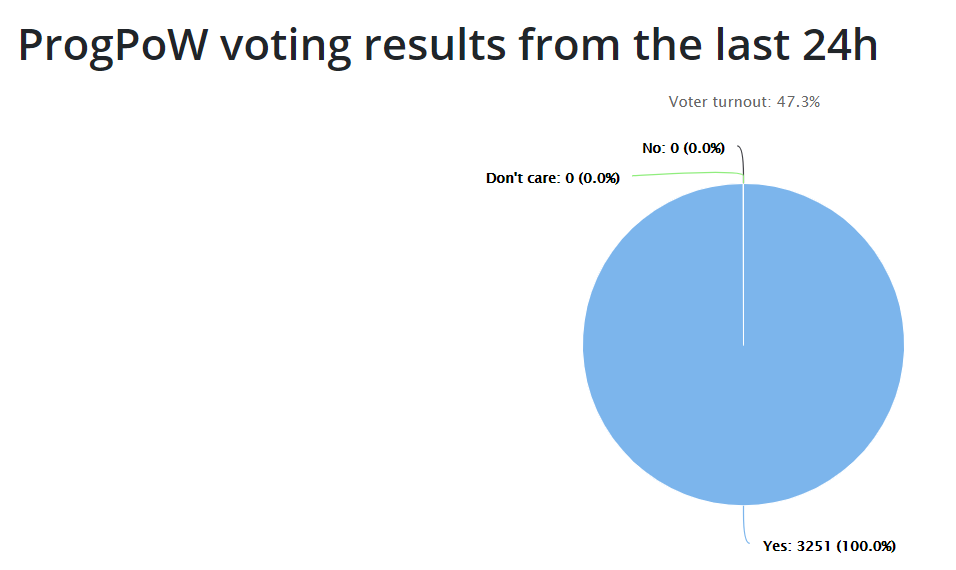

- Miners have already positioned voting support for the move to ProgPoW based on polls found on etherchain.org and have tools available to signal consensus.

This is where the notion of skin-in-the game becomes critical. There are many models for this, each with their own trade-offs:

- One CPU, One Vote — This does lead to miner centralisation, especially as ASICs enter the fray (the issue at hand for ProgPoW). It also has the contentious hard fork bug as PoW is great at keeping rules, terrible at making new ones.

- One coin, One vote — Generally subject to noise and in the landscape of lending and Sellout-DAO, relatively gameable. It also tends towards pultocratic or oligarchic governance and gives immense leverage to the largest holders with few tools available to dethrone them.

- Opt-in, show us your skin, One _appropriately_ sized vote — This is Decreds model. Align the incentives by binding the voters savings/investment to the success of the chain for an indeterminate amount of time. Voters must feel the risk of their decision and as a result, those who have the most economic value at stake, will make a rational decision. Much like ASICs in PoW, and Validators in PoS, voters can be incentivsed to protect their investment so long as it is in their best interest.

Now, Ethereum has many more moving parts than Decred or Bitcoin and the author does not have the full answer. However he notes that Eric is asking the same question, and there is no doubt Ethereum has enough smart people out there to tackle the trade-offs and realities.

The tricky bit for the Ethereum community is ensuring that the skin-in-the-game of the very large players (read: founders, developers and EF) play within the clearly established rule-book as designed by the community. You also have the added bonus challenge of lending and money markets to muddy the waters, the author will leave that stone unturned.

Nevertheless, your current tool kit of counting node versions and risking a chain split is not ideal and it is largely incompatible with your DeFi layer.

4. Become the DAO of DAOs

Ethereum is already a DAO of sorts, it is just missing a key ingredient of an efficient mechanism to coordinate contentious issues (outside toxicity and confusion). The long term outcome is ossification which at this stage in the game, is not ideal given the innovation currently underway.

Bitcoiners will always criticise Ethereum (and Decred) for having a coordination mechanism. Ignore them. Let Bitcoin do it’s thing and calcify as hard money.

Decred is the perfect contrarian answer to Bitcoin. It embraced human intelligence and enables it to be decisive via formalised, hive mind coordination. It looks at the world from the lense of what can be accomplished with teamwork and forfeiting time lost on toxic and unproductive arguments. Decred instead opts to educate, inform, put money on the line and make the call.

The author sees no reason Ethereum would lose on adoption of a similar model, even if the model comprised only unforgeable soft signals via on-chain tools. Just give the community a voice beyond node versions and twitter polls.

Decred, as a DAO, generally follows Scott’s solution pathway, favoring conservative, informed and progressive governance and evolution. Where consensus is not met, it maintains the status quo (ossification).

Contentious or not, Decred makes a decision and delivers it.

Ethereum already hosts numerous sub-DAOs each with their own mandate and economic value. These sub-DAOs can aggregate meaningful votes and tally actual economic weight behind their decision. The author sees no reason why Ethereum cannot create DAOs which could even issue temporary vote tokens (or an equivalent), under a token standard, purely for approving hard fork consensus changes.

Anchor these tokens into a Politeia instance (just like Decred tickets) with each one representing the aggregate voice of like minded people. Votes come in from plethora of sub-DAOs, DeFi applications and businesses built on top of Ethereum. Most likely, this system could be integrated directly into one of your clever smart contract wallet interfaces.

Lessons Learned from Decred

In summary, the author sees a handful of key lessons learned and parallels with Decred’s model. Some may (or may not) be applicable for consideration for Ethereum:

- Decred functions by a combination of off-chain and on-chain governance mechanisms. The eth-native technology is available for Ethereum to build all the on-chain parts (DAOs, collateral contracts, token standards etc). The challenge comes in shaping the off-chain social layer. Giving the community tools to be heard beyond twitter polls and gameable petitions will likely prove fruitful and spur on further governance innovation.

- Toxicity is time lost. The essay linked above perfectly summarises the Bitcoin model of consensus by toxicity, and Decred is the perfect contrarian vote against it. Toxicity is a defense mechanism, and despite it’s imposing stance, it is generally unproductive. Clarity in signal is immensely more powerful and we have tools for ultimate transparency and reliability at our disposal.

- The EIP process can be interwoven with a system like Politeia where account identities require some small upfront capital to generate (0.1 DCR / 0.01 ETH), making spam costly. Perhaps this scales with economic vote/signal weight sought by the entity.

- Creating a pool of known, trusted, pseudonymous cryptographic identities. Once MolochDAO, Ameen, Eric or the future heavy metal fan club MetallicaDAO have a verified Politeia identity, it becomes trivial to vote and tally a legitimate and unforgeable consensus. The community often follows these thought leaders (especially MetallicaDAO).

- Politeia (or similar) forces developers proposing changes to educate, inform and win over the community to minimise abortive works and de-risk contention. It also provides a central, uncensorable platform for the community to push back, request clarification and get contentious if and when it’s required. These records are stored for generations to come as a reference of where we have been.

- Politeia manages censorship by anchoring the conversation into the Decred (or Ethereum) blockchain on an hourly basis. If someone’s comments are censored, Politeia issues a censorship hash and a mandatory reason for the censorship by the administrator(s) as proof it occured.

- Skin-in-the-game is an essential component of governance. Those with the most skin, feel the risk of consensus level decisions the most. The secret sauce is making sure that any capital that attests to a vote, is bound to the decision outcome as judged by the market. How this works with Ethereum’s unique token distribution, lending markets and varied stakeholder pool remains a challenge.

- Triggering the ‘contentious fork process’ only after meeting some quorum of node upgrades or other signal. Decred for example requires 95% of miners and 75% of stakerholders to upgrade nodes with the inert code before any consensus vote starts. Perhaps Ethereum EIPs have some trigger event after a sufficient volume of identities attest that it is indeed contentious.

Conclusion

Ultimately, governance is a really hard problem and bolting a system on in the rear view mirror even more so. ZCash, BCash and now Ethereum are all high profile projects with governance on the agenda. As much as Bitcoiners like to say governance doesn’t exist, it certainly does, and it makes or breaks a protocol.

As the Ethereum project moves to Proof-of-Stake, there is an opportunity to consider how such governance systems could be built into to social and technical layers to enhance the longevity of innovation.

Ethereum embraces open innovation, why are you risking it all with reliance on the Bitcoin model of upgrading nodes to form consensus?!

Any social consensus mechanisms does not even need to be on-chain binding. Just provide your community with a mechanism for providing miners and devs with unforgeable, verifiable attestations of their views.

We are still humans and blockchains are worthless and defunct without us. There are stakeholders of all sizes in the mix and their economic contribution is dynamic, subjective but often measurable. The author believes that if the governance of a system that affects everyone becomes concentrated, the system will eventually collapse, with countless instances through human history as evidence.

Decred has pioneered a strategy of gamifying good governance to ensure both its store of value properties and its innovation potential is strengthened and progressed over time. Many of these features may not be directly compatible with Ethereum 1.0, however, some of the software and many of the principles certainly are, and even more so with 2.0.

Provide your community with unforgeable mechanisms to have legitimate voices. Go beyond relying on counting node versions and deploy Ethereum’s own brand of verifiable signal. Cut the unproductive noise out of the system.

The trends, patterns and arguments the author has observed during the ProgPoW debate, appear to have thinkers converging on many solutions Decred has elegantly solved in its own bubble.

Lessons are there to be learned, the validity and applicability of these ones are left to the Ethereum community to ponder. If a single productive discussion comes from this article, the author has hit his goal.

Comments ()