In Defense of Stability: A stable coin Comparison

Stablecoins have emerged as an important bridge between the world of digital assets and the stability sought by parts of the market.

In the dynamic, and sometimes crazy, crypto market, price fluctuations are common and unpredictable. The need for stability became a reality since the tumultuous ups and downs have shown the importance of creating a safer spot for investors. Stablecoins are considered part of the solution, due to their ability to bridge the gap between the innovative potential of cryptocurrencies and the practical stability that is required to be a part of everyday life.

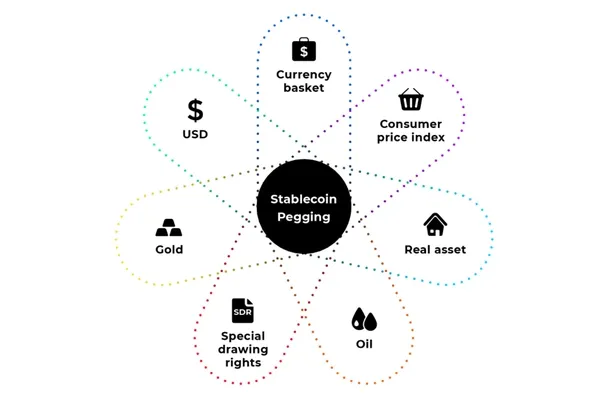

Stablecoins are a type of cryptocurrency with stable value, usually pegged to a stable currency, like the US dollar, or a commodity, like gold. Even with the desired stability, there are also some risks in maintaining the parity between currencies. Reserves backing stablecoins need to be transparent and secure, and there must be awareness of regulatory scrutiny, particularly if the coin pairs with a fiat currency.

In this article let's analyze the characteristics of stablecoins and some key cryptos with those attributes. By understanding this group of coins, we seek to unveil its importance and contributions to the crypto market.

What are the main Stablecoins?

Tether (USDT)

A decade ago, the origins of Tether went back to J.R. Willet's will to develop novel cryptocurrencies using the Bitcoin protocol. Willet's implementation of this concept materialized, and with early participation of the mastercoin foundation, Tether would be established in 2014.

The utilization of Tether to liquidity started with its integration into the BitFinex exchange in January 2015.

Tether is a stablecoin whose value is pegged to the US dollar. This coin aims to provide a "secure" digital asset with a stable valuation. The concept underlying Tether is that regardless of the prevailing market conditions, you can always exchange 1 Tether for a fixed value of $1.

How does it work?

Tether tokens get issued in various blockchains, such as Ethereum (as a ERC-20 token), and Tron (as a TRC-20 token).

When a user deposits fiat currency into Tether's reserve, exchanging their fiat for USDT, Tether generates an equivalent digital quantity of tokens. These USDT tokens can be transferred, stored, or traded. Tether tokens maintain a strict 1-to-1 correlation with the US Dollar (1 USD₮ = 1 USD), and these tokens are fully supported by Tether's reserves.

Tether can sustain its proximity to that value as long as it maintains its unchanging 1-to-1 relationship with the currency (or equivalent assets) to which it is tied. During May 2022, the value of Tether experienced a momentary dip, briefly reaching as low as $0.96. This drop was triggered by the decline in the value of another stablecoin, TerraUSD (UST).

However, the value of Tether tokens promptly recovered. Tether assured its commitment to upholding the redemption requests at a steadfast 1-to-1 ratio with the U.S. dollar.

Tether is a centralized crypto, while coins like Decred, and Bitcoin are decentralized since they are not pegged to a real-world commodity.

USD Coin (USDC)

The stablecoin USDC started operating through the collaborative efforts of CENTRE, an entity established by Coinbase, a cryptocurrency exchange, and Circle, a FinTech. USDC is also a cryptocurrency designed to keep a continuous value of 1$ USD.

CENTRE and Circle assure that USDC reserves are kept in the custody of renowned financial institutions, including BlackRock and Bank of New York Mellon. Some critics say that this reserve concentration in the hands of traditional finance does not match the crypto market ethos. The good part of this characteristic is that financial institutions can securely hold USDC without being exposed to value fluctuations. With that more money is attracted to the crypto market.

How does it work?

Initially introduced on the Ethereum blockchain as an ERC-20 token, USDC has broadened its reach to additional blockchains like Solana, Stellar, and Algorand. This expansion allows users to access USDC across various blockchain ecosystems. The coin is obtainable through both centralized exchanges and decentralized exchanges.

New USDC tokens are generated when individuals and businesses place deposits of United States government-backed currency (USD) into their Circle accounts. When people exchange their USDC for USD, the tokens are "burned," which means they are taken out of circulation. This process ensures that the number of tokens in use matches the USD held in reserve.

On March 11, 2023, USDC's direct link to the dollar was disrupted following Circle's confirmation that around $3.3 billion, roughly equivalent to 8% of its reserves, faced jeopardy due to the collapse of Silicon Valley Bank. The coin fell below U$0.87 but shortly after it recovered its value.

DAI (DAI)

For many, Dai is the most widely used and relevant decentralized stablecoin in the entire cryptocurrency market. The asset was developed by MakerDAO and launched in 2017, also leveraging the structure and foundation of the Ethereum network's ERC-20 protocol.

Similar to other stablecoins, Dai is related to other cryptocurrency blockchains. Therefore, it utilizes networks, primarily Ethereum, assigning the network the role of collateral. This means that its smart contracts are responsible for ensuring the stability of its value and its relationship with the dollar.

How does it work?

Dai is also anchored to the U.S. dollar. To uphold its value, Dai employs a mechanism known as the Target Rate Feedback Mechanism (TRFM). The primary objective of Dai is to maintain a value of $1. When the price falls below $1, the TRFM is activated to boost the price back up.

The main advantage of the Dai network lies in its decentralized nature. It is managed by a decentralized autonomous organization through a software protocol, like many of the main cryptos of the market. Dai operates on the Ethereum blockchain, and its blockchain is open to everyone.

Each action within the blockchain is transparently documented by self-executing smart contracts, powered by Ethereum. This design enhances transparency and minimizes the risk of manipulation.

Furthermore, the Dai ecosystem incorporates a democratic governance structure, just like Decred, ensuring that every alteration and decision is subject to the votes of ordinary participants.

Moving Foward

Stablecoins have emerged as an important bridge between the world of digital assets and the stability sought by parts of the market. Among those coins Tether, USD, and Dai are good examples of the diverse approaches to achieving value stability in this dynamic environment.

What is your opinion on stablecoins? Do you usually buy them? or do you think they are not that importnat to the crypto market? Leave a comment with your opinion!

Comments ()