Digital Tokens are gaining space between banks and other companies, could this be an opportunity to grow and diversify our project?

Agricultural producer Wagner Cruvinel, from Goiás (a state in the Brazilian Midwest), found a good opportunity for buying a new tractor at Show Rural Coopavel, a fair held in February in the city of Cascavel. After visiting some exhibition stands and analyzing the various tech possibilities, the producer decided to close the deal in an innovative way, unprecedented in Brazil. He financed part of the machine's value with the automaker's bank, but the payment was not made in cash but with the so-called "digital grains." The operation was possible thanks to the token technology, which is gaining space in agricultural trade in the country. It is a digital certificate with encrypted data, which ensures security and data confidentiality.

"I needed to buy the tractor and had a contract to receive from the sale of soybeans. But my money wouldn't come in on the day I closed the deal. So, they turned my contract into a digital currency that the bank used as payment," he said

Wagner Cruvinel says he has become an enthusiast of cryptocurrency because he completed the tractor purchase 60 days before the expiration of the soybean sale contract and will also pay the next instalment of the financing with digital currency. "The new system makes the sale of the grain flexible and gives independence from the trading companies," says Cruvinel, who, in addition to being a farmer, has a resale of agricultural products.

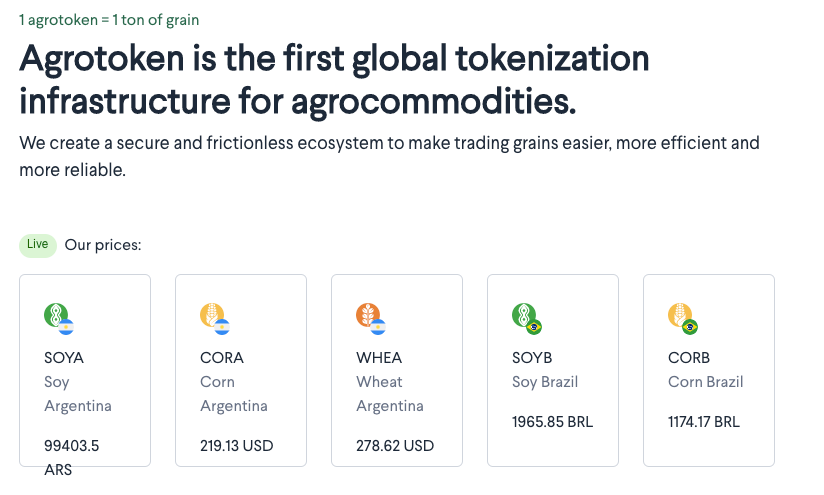

The operation with the soybean producer from Goiás was guaranteed by Agrotoken, a startup founded in 2020 in Argentina and operating in the Brazilian market since January of this year. The operation was based on a digitally-made credit assignment.

The sale contract of the grain is the basis of the operation. The farmer transfers the rights over this transaction to Agrotoken, which converts the value based on reference prices for agricultural commodities valid throughout Brazil and advances the customer to what he would only receive on delivery of the crop. The resource is available in an account like a credit card, through which the producer can make any transaction "paying in virtual soybeans" or any other product, from coffee to a brand-new car, from inputs to agricultural machinery. Anderson Nacaxe, the company's director in Brazil, explains that the business model has similarities with cryptocurrencies. These tokens are generated from real and tangible assets, in this case, grains. He explains that the company's role in the entire operation is similar to that of a clearinghouse.

When the grains sales contract that served as coverage for the token is settled, payment is made to the startup, which refunds the liquidity provider for that operation. The company's goal for 2023 is to tokenize at least one million tons of Brazilian grain production. The startup network is built around the Ethereum, Polygon, and Algorand blockchains. To learn more about Agrotoken read its whitepaper here!

Moving Foward

The Decred project has developed many applications around its blockchain. The network has its decentralized exchange (DCRDEX), which innovates with atomic swaps and makes it possible to trade without any arbitrary fees. It also launched Bison Relay, a new take on social media that preserves privacy and free speech. Do you think the Decred network could be open to projects like Agrotoken? Digital Tokens are gaining space between banks and other companies, could this be an opportunity to grow and diversify our project? leave your opinion in the comment section below!

Comments ()