The purpose of Zcash is to allow people to send and receive funds quickly, cheaply, and privately. This article aims to do an honest comparison between Decred ($DCR) and ZCash (ZEC)

Almost every day is possible to see the launching of new crypto projects. They come from many parts of the world, each with a specific focus, some aiming at privacy, easy transactions, or security. Some don't even have a clear goal, like the meme coins DOGE and SHIB, yet they manage to bring a community together and gain significant market value.

A coin that recently caught the attention of the Decred community was Zcash. A cryptocurrency launched in 2016 that bets on decentralization and fast transactions. The purpose of Zcash is to allow people to send and receive funds quickly, cheaply, and privately. This article aims to do an honest comparison between Decred ($DCR) and ZCash (ZEC), observing their similarities and differences, to understand new possibilities for the progress of the Decred project.

Operation

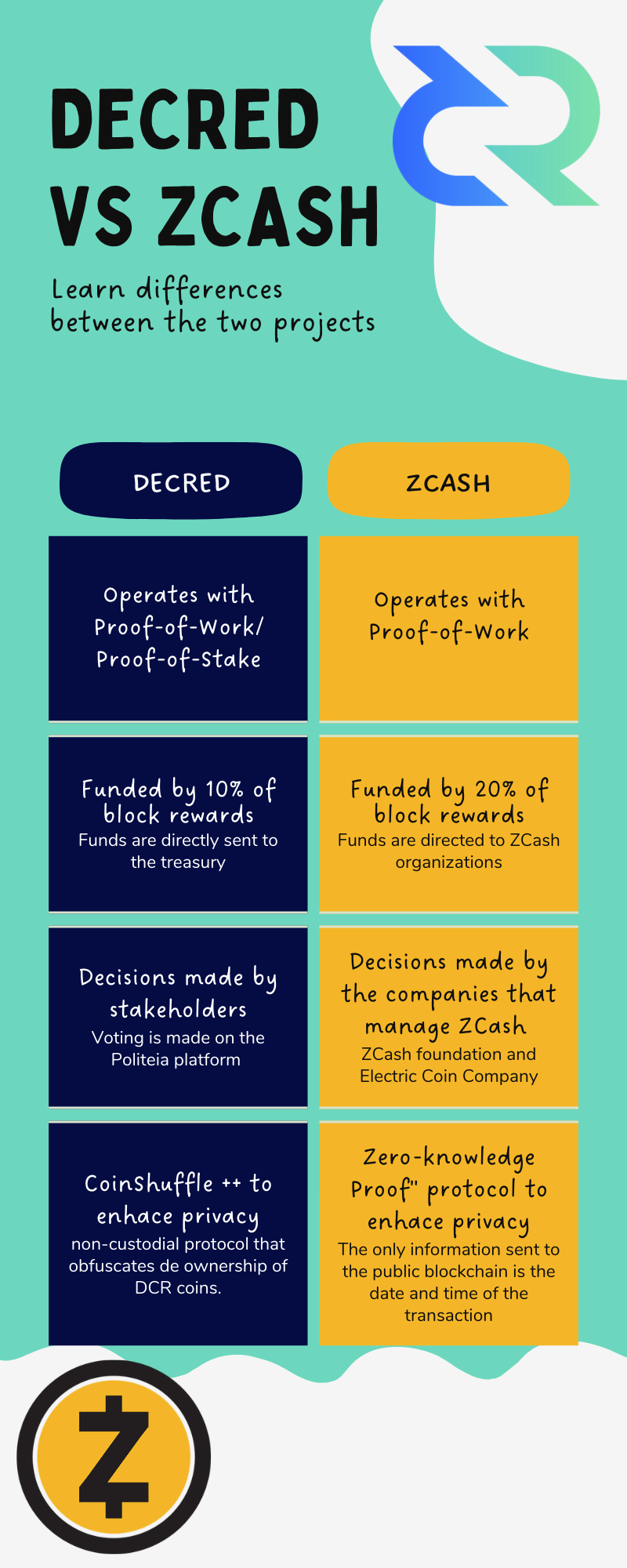

As we know, Decred works with a hybrid consensus blockchain to validate transactions. Block rewards are split between Proof-of-Work (PoW) miners – 10%, stakeholders (PoS) – 80%, and the Decred Treasury – 10%, which funds the project. This layered consensus mechanism now privileges stakeholders, since voting is central to Decred's governance. Proof of Work is still essential for the security of the network. But received a decrease in the reward (60% to 10%) this year, since Decred wanted to ensure that a small group could not dominate the flow of transactions or make changes to Decred without the input of the community.

Zcash, only uses the Proof-of-Work consensus model. All network transactions get validated by computer power, leaving the network dependent on its miners. One advantage of Zcash mining is that people can use a CPU or GPU to mine it, unlike Decred or Bitcoin, which need ASIC hardware. This makes ZCash mining more accessible.

A great advantage that Decred has over Zcash is the level of decentralization. Every decision, involving Decred treasury spending, must be voted on using the Politeia platform. Decentralized governance has been the primary focus of Decred since its launch in February 2016. Nowadays, the project is moving toward total decentralization.

ZCash on the other hand, is run by a private organization, called Electric Coin Company (ECC), meaning that decisions in ZCash are made based on hierarchy, small stakeholders do not get a chance to decide the future of the project.

Funding

Zcash funding is made by 20% of all block rewards. Before the halving that happened in November 2020, these rewards were distributed in the following manner:

- 9.85% to the founders of the Electric Coin Foundation;

- 2.2% to the ZCash foundation;

- 5.75% to the Electric Coin Company;

Many members of the ZCash community were not happy with this distribution of resources. Discussions started at the ZCash community forum and those debates reached a new agreement for the division of block rewards after the halving, aiming for more decentralization for the project:

- 8% to the Major Grants Fund

- 7% to the Electric Coin Foundation;

- 5% to the ZCash foundation

The Major Grants Fund will support development through large-scale long-term projects, which will be managed by the Zcash Foundation and will have extra community input and analysis.

As said before, Decred funding is done through 10% of all block rewards. These funds go to the Decred treasury, which finances development and operations. This concrete and transparent self-funding element ensure that Decred is sustainable.

Decred funding is organized to fit the open-source ethos of the project. The treasury funds are directed to the project advancement and arranged through discussion and voting on the Politeia platform. It is unprecedented for open-source projects to have this kind of funding. This way of managing funds is efficient when combined with Decred's new paradigm of work, the project tries to unlock the true potential of their contributors by developing a funding model united with the new way of working.

Transactions and privacy

Decred's blockchain has a public ledger of all Decred transactions, which includes the senders, recipients, and amount sent. The senders and recipients have a cryptographic public key, not being identified by a real-world personal identity. This system provides pseudonymity but not total anonymity, all transactions are listed and can be checked in the Decred Block Explorer. If one of your personal transactions is connected to your real-world identity, it may be possible to build a transaction graph that profiles more of your personal activity.

In 2019, the CoinShuffle++ (CSPP) mixing protocol was implemented by Decred, aiming at increasing user privacy. CSPP is a non-custodial protocol that obfuscates ownership of DCR coins. Output addresses get anonymized via mixnet, a cryptographic protocol executed by mix-servers that provide anonymity for a group of senders. The implementation of this protocol did not require changing the consensus rules, it was an opt-in implementation.

The main limitation of the implementation of the CSPP protocol is the use of a centralized server. The anonymity provided by CoinShuffle++ can be lost if wallet addresses are reused, or if change outputs are not handled correctly.

The main technology behind Zcash blockchain is the "Zero-knowledge Proof" protocol. This protocol allows transactions to be made anonymously. The only information sent to the public blockchain is the date and time of the transaction, ZCash network can verify a transaction without exchanging passwords.

With ZCash there are two types of addresses: i) Transparent address: transactions with this address can be tracked on the ZCash blockchain just like a Bitcoin one; ii) Shielded Addresses: encrypted ones, meaning that you cannot see the data on the blockchain. If a transparent address sends funds to a shielded address, observers won’t be able to tell where they went. If a shielded address sends a transaction to another shielded address, the transaction is entirely shielded from spectators.

The strength of ZCash may turn out to be a weakness too. It is very difficult to trace if someone is using ZEC to reach malicious goals. You cannot trace the route of a ZCash coin. With reports of dark web marketplace, AlphaBay, contemplating the use of Zcash, the protocol’s trustworthiness remains to stay behind a screen of doubt.

Moving Foward

In August, the Electric Coin Company shared its plans to move the ZCash consensus mechanism from proof-of-work to proof-of-stake. The company is researching the best way to make this transition, focusing on areas that will impact privacy, expansion, and the experience of ZEC users.

Alternately, Decred is focusing on developing DCRDEX, a peer to peer exchange which is aiming to be an interoperable environment. Where DCR users can exchange DCR with other coins freely with no arbitrary transaction fees, making Decred the only DAO with its own DEX, Digital Wallet, and own blockchain.

Which future looks more promising to you or are there some important facts that I've overlooked?

Comments ()