Decred — An alternative contender

As we spend more and more of our lives online, our virtual worlds won’t always be constrained by our offline borders. Much like the current web allows us to exchange information with each other, a blockchain enabled Web will enable a peer to peer exchange of value.

Table of Contents:

- Cryptocurrencies — Digital free market money in its early stages

- Bitcoin has some unanswered questions. Decred offers interesting alternatives.

- Decred is bootstrapping a war chest without external investors.

- Exit, Voice and differing paths to sound money

- A financial premium for security and peace of mind

- Conclusion

Cryptocurrencies — Digital free market money in its early stages

As we spend more and more of our lives online, our virtual worlds won’t always be constrained by our offline borders. Much like the current web allows us to exchange information with each other, a blockchain enabled Web will enable a peer to peer exchange of value. Blockchain based digital money — aka cryptocurrencies — offer breakthroughs in virtually storing and transferring money.

Much like physicists have theorized about Higgs Bosson, economists have explored the concept of a free-market money for several decades. Nobel laureates like Friedrich Hayek have theorized possibilities where privately issued moneys could compete along side publicly issued money. In such a world, people would be able choose from different types of money based on differentiated value propositions, rather than its geographic origins.

The 2008 invention of Bitcoin created a digital form of apolitical money which is inflation proof, agnostic of land borders, and does not require reliance on a third party in order to be transported anywhere in the world. Features like economic scarcity and imperviousness to national politics gives Bitcoin the characteristic potential of a new form of digital gold.

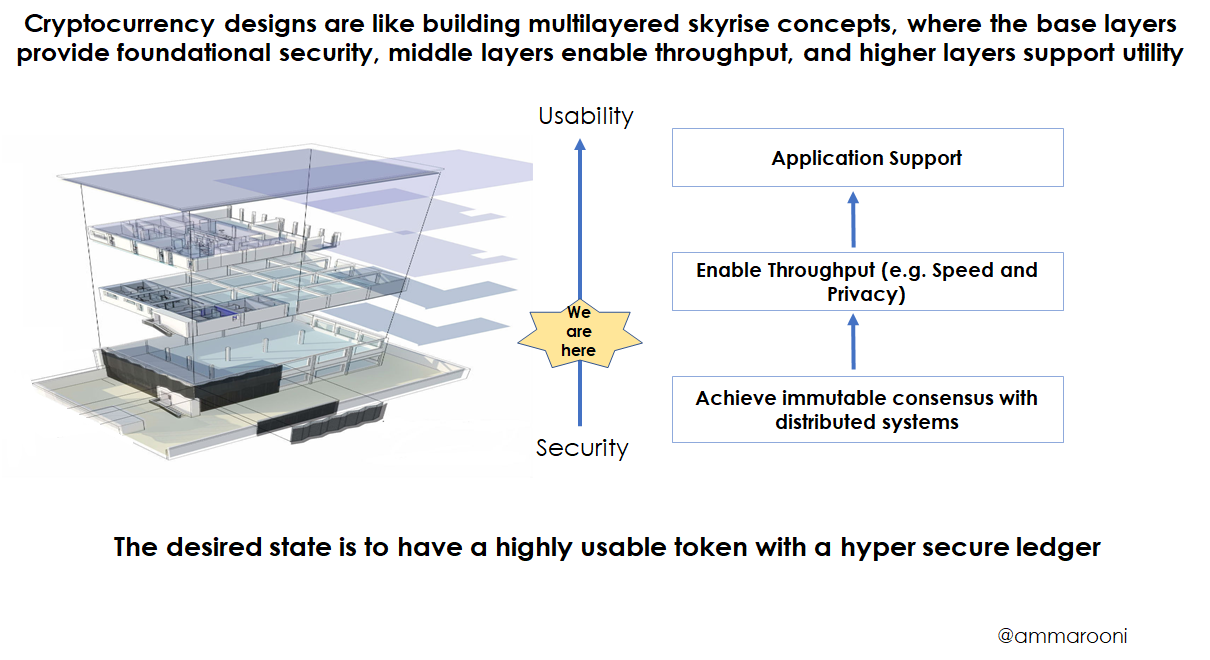

While cryptocurrencies are currently in their infancy stages, they have remarkable potential for value accrual as blockchain applications grow over the coming decades. Accordingly, their merits should be evaluated on their extensibility, resilience, and an understanding of how they allow us to co-ordinate and capture value.

This research paper highlights how Decred has social, financial, and technical resilience, which are ingredients for long term durability.

Bitcoin has some unanswered questions

Bitcoin is by far the most well known and most secure cryptocurrency in the world today. It has shown more than a decade of resilience, is already worth between $150 to $200 billion dollars today, and shows potential to be worth trillions some day.

While Bitcoin has unparalleled technical strengths, high brand recognition and a first mover advantage, it’s design has some unanswered questions which may present long term risks, and require critical examination.

Durability for the next 100 years

Software products die without engineering support. Cryptocurrencies are unique in that they are vying to be economic assets, but they are also software products. Durability is an economic property of money, and if programmable money needs to last hundreds of years, it needs a mechanism for sustained financial support. While Bitcoin functionally automates many of the functions of central banks, its design is reliant on a concentrated group of investors and donors for financial sponsorship. While private companies like Blockstream fund Bitcoin today, there are long term unknowns in how long these parties will be willing to continue this sponsorship. Even with the noblest of intentions of current financiers, private investors inevitably need an exit event, and Bitcoin needs to prepare for a risk event where the interests of its current investors conflict with those of its future holders. A dependency on external funders, a lack of governance clarity, and susceptibility to network splits are unaddressed areas in Bitcoin’s design.

According to Hayek’s theories of free market moneys, different moneys can compete in parallel by offering different value propositions. If Bitcoin can become valuable after 5,000 years of gold due to its unique differentiation, other cryptocurrencies will also be valuable if they can sufficiently differentiate and compete in vectors not addressed by Bitcoin’s design.

What if there was an alternative to retain the sound money properties of Bitcoin, and address its lack of sustainable funding, governance clarity, and risk of network effect leakage? This research paper looks at Decred, a hyper secure cryptocurrency which retains the best properties of Bitcoin, but optimizes for Bitcoin’s weaknesses from unique positions of strength.

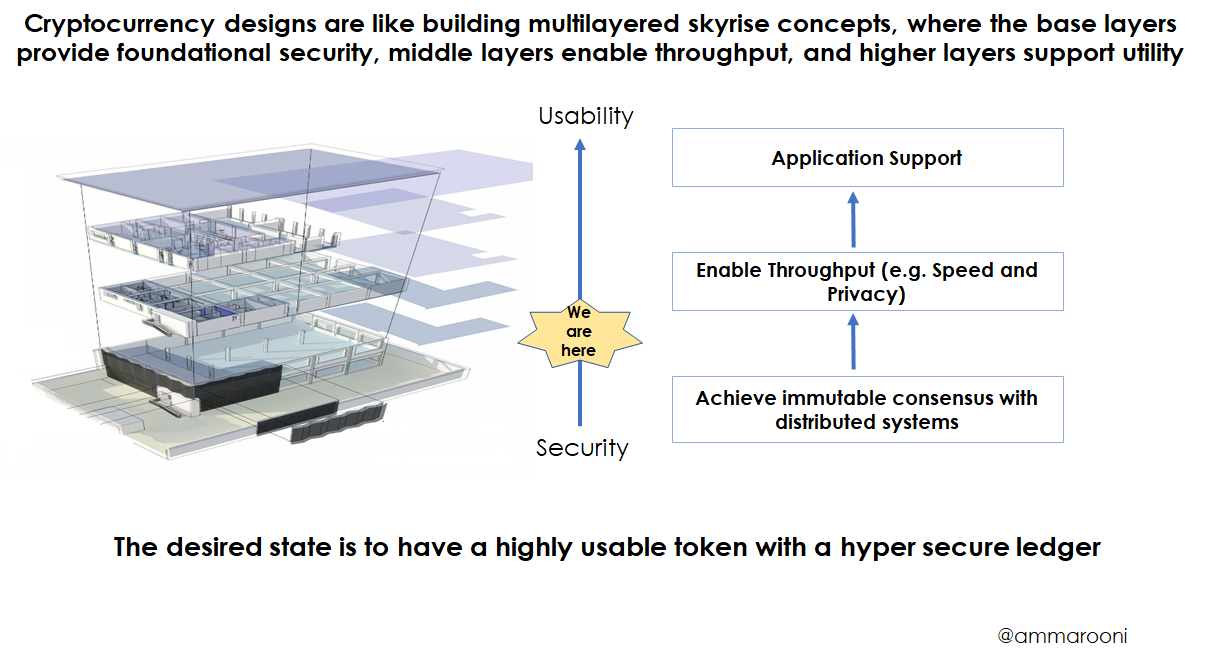

Decred is bootstrapping a war chest without external investors.

Unlike Bitcoin’s design which requires investors and donors, Decred has a self-sustaining mechanism to fund its ecosystem. In Bitcoin’s design, the value of all newly mined $BTC goes to miners, whereas Decred’s design allocates 10% of the value of every newly mined $DCR into a Treasury fund, which acts as a venture fund to support the Decred ecosystem.

The Treasury Fund gets richer every 5 minutes with the mining of new DCRs. This fund is valued between $10 to $20 million based on 2019 market valuations, and is designed for exponential growth in the long run. Decred’s token supply schedule is known, making it possible to model the Treasury inflows over time. The treasury fund’s future can be broken by its known variables:

- Inputs (the number of tokens in the treasury times the token value)

- Outputs (the operating expenses required to draw down and support the project).

Treasury value = (Tokens held in Treasury x Token value) - Operating Expenses

How much cash could Bitcoin have had, if Bitcoin had Decred’s design and a Treasury Fund? Up to $18 Billion.

To date, almost 18 million Bitcoins have been mined. At recent prices of $10,000 and with a Decred-like 10% treasury allocation, this could have resulted in close to $18 Billion in cash inflows if Bitcoin had its own Treasury Fund. Note that the actual number would be a bit lower, as operating expenses for protocol development would have drawn down funds from this.

While it is not possible to change Bitcoin’s design to add in a self-funding mechanism, we can apply this model to Decred’s design for a sensitivity analysis of Decred’s Treasury Fund. We will project hypothetical 2025 valuations with the following inputs and assumptions:

- We will use Decred’s known supply schedule to show the treasury inflows by 2025. Using its 10% allocation design, 1.74 million DCR tokens will have been allocated to the treasury fund.

- Since it’s impossible to predict the token value of DCR five years from now, we take the position that if cryptocurrencies are not a fad in the next half decade, they will be more valuable in 2025 than they are in 2019. We will use 3 sensitivity points for our model: Decred’s 2019 low price, Decred’s 2019 September price, and Bitcoin’s 2019 September price. Checkmate has done some great analysis to show the stock to flow parallels between these projects, and how Decred is mirroring and exceeding Bitcoin’s early performance.

- In order for Decred to continue funding its ecosystem development, the cash on hand needs to account for operating expenditures. Decred has already managed to launch a functioning blockchain protocol by drawing 20 to 25% of its Treasury funding in the first 3 years of its existence. For conservative sake, we will assume a 30% draw down rate.

- This model assumes a linear growth in operating expenses and the DCR Treasury. In reality, the treasury fund is denominated in DCR, which will multiply in line with DCR value appreciation, while expenses will be incurred in USD. This will be offset by periods of market fluctuations where the value of DCR drops, and expenses continue to be incurred.

Key insights:

- Decred’s Treasury has the potential to bootstrap billions of dollars, and its design creates a perpetual cash flow mechanism.

- Decred as a whole today is valued at below the future cash potential of its treasury fund. Being priced under cash represents a current market inefficiency.

If cash inflows are one half of financial management, cash outflows are the other. Decred vests this drawdown power in the hands of its token holders much like companies vest decision making in their board of directors. Governance features for DCR token holders is a differentiating feature in addition to its use-case as a store of value currency. In this manner, Decred combines features of money with shareholder rights.

Governance: Exit, Voice and differing paths to sound money.

Decision making rights can be explicit or implicit. Not defining community governance processes doesn’t mean that power isn’t vested somewhere. While Bitcoin decentralizes monetary policy away from nation states, the lack of clarity in its decision making process has the potential to create new hidden power structures. While Bitcoin as a Digital Gold analogy works in many ways, this thesis needs to account for the fact that Bitcoin is a software project with a small number of unelected developers with access to the code base. Bitcoin holders rely on an unwritten “social contract” with the developers, although this term itself is not defined anywhere. These ambiguous decision making processes may create unaddressed risks in the medium and long term:

- In the medium term, if Bitcoin needs to upgrade its cryptography, who gets to decide the process of changes?

- In the long term, will nation states cede monetary policy making to the Bitcoin network without a governing constitution?

Traditional fiat money is criticized in how it creates unfair advantages for governments whose currency enjoys reserve currency status. If the US or China decide to devalue their currency, every other country holding their reserves in USD or RMB get their purchasing power debased without recourse.

To support a Global Store of Value thesis where nation states will one day hold crypto assets in their reserves, Decred provides a unique store of value where holders of money get a seat at the governance table, along with a guarantee not to be debased.

Without Voice, Exit becomes a threat to network effects

Bitcoin and Decred share fixed supply and sound money characteristics, but take different approaches in incentivizing loyalty. While holding Bitcoin provides an upside in its capital appreciation and an uninflatable asset, holding Decred provides additional benefits of having a voice in the ecosystem’s decision making process.

Economists and social scientists like Hirshman Albert have studied the effects of voice and exit on loyalty. If cryptocurrency adoption eventually reaches billions of people, there will be a large variety of voices and opinions. We need to solve for governance in cryptocurrencies now, so that we have a mechanism to resolve disagreements two decades from now. If Bitcoin represents a sound money exit from inflationary government issued fiat currencies, Decred represents sound money with voice.

Bitcoin’s design is brittle in order to be apolitical, and does not allocate voice to token holders in its decision making process. By contrast, Decred makes decision making transparent and sets high thresholds to retain community consensus, in order to co-ordinate adaptability in the long run. This bodes favorably for retaining network effects.

Bitcoin’s approach to resolve community differences is for people to exit the network. Decred’s approach to resolve community differences is for people to buy more $DCR, so that they can have a bigger voice at the decision making table.

Much like traditional businesses study the concept of leakage, crypto networks need to study how community splits (forks) erode their network effects. When one group exits a crypto network, it implicitly weakens the value for all other token holders. Decred is uniquely positioned to be fork resistant, both technically and socially.

From a technical design, Haon has done some great analysis on how Decred is more fork resistant than networks like Bitcoin and Ethereum.

Over a long term horizon, what further differentiates Decred is its social resilience, in how it creates behavioral incentives for network loyalty. Specifically, Decred’s design of empowering $DCR token holders with voting power over its network, and allocating access to a burgeoning treasury fund are forms of switching costs. Decred holders are incentivized to retain their $DCR ownership, as selling the token implies surrendering governance rights over the ecosystem and the treasury fund. You can leave the network, but you can’t take the treasury with you. Holders are socially and financially incentivized to remain loyal to the Decred ecosystem.

A financial premium for security and peace of mind

Humans are willing pay a premium for security when it comes to safeguarding money. At a macroeconomic level, this is why governments hold their savings reserves in foreign currencies backed by the most weapons (the US Dollar today). At a microeconomic level, this decision making process is why consumers choose higher interest rates payments of “fixed” interest rates when taking loans, even where variable interest rates are cheaper. Guaranteeing predictability and security creates value.

A York University study covering 1950 to 2000 found that consumers would have been better off choosing a variable-interest rate 90% of the time as compared to fixed rates. Yet the ‘fixed’ option is often preferred, which generates hundreds of billions in global revenues for banks.

If cryptocurrencies are money enabled by blockchain, they need to address our primal needs of securing our valuables. Trust in a cryptocurrency begins with the tamper proof strength of its blockchain ledger. The technical security for cryptocurrencies is measured by their strength against double spending attacks. In this dimension, Decred is extremely secure. Zubair Zia has done some excellent analysis to show how on an apples to apples basis, Decred is ~22x more expensive to attack than Bitcoin, and ~9x more expensive to attack than Ethereum. As Decred scales, it only needs a fraction of Bitcoin’s market cap to become more secure.

The real flippening will be if another network overtakes Bitcoin in the cost of double-spending. Decred’s design gives it that shot.

The behavioral change from government backed currencies to a non-sovereign software as a store of value requires a massive leap of trust. Cryptocurrencies make this trust possible by providing economic security (protection from debasement) and technological security (protection of the blockchain ledger). Decred is a contender on both fronts.

A bullish future

Decred has technical, financial, and economic soundness in its protocol design, along with a resilient social structure. These ingredients work in harmony to foster a secure, inclusive, and adaptive ecosystem. Decred’s protocol design shows remarkable foresight, which may play out as differentiated advantages over other cryptocurrencies.

Bitcoin is solving problems with fiat money that are not visible to the naked eye, but will become prevalent over time. Decred is addressing the design limitations of Bitcoin which are not visible today, but may become manifested over time.

Acknowledgements: I want to thank Haon, Permabull Nino, Checkmate, and Jonathan Zeppettini (aka jzbz) for being kind enough to proof read earlier versions of this article.

Disclaimer: This article is meant for informational purposes, not as professional investment advice.

Comments ()