Why does Decred have its own exchange?

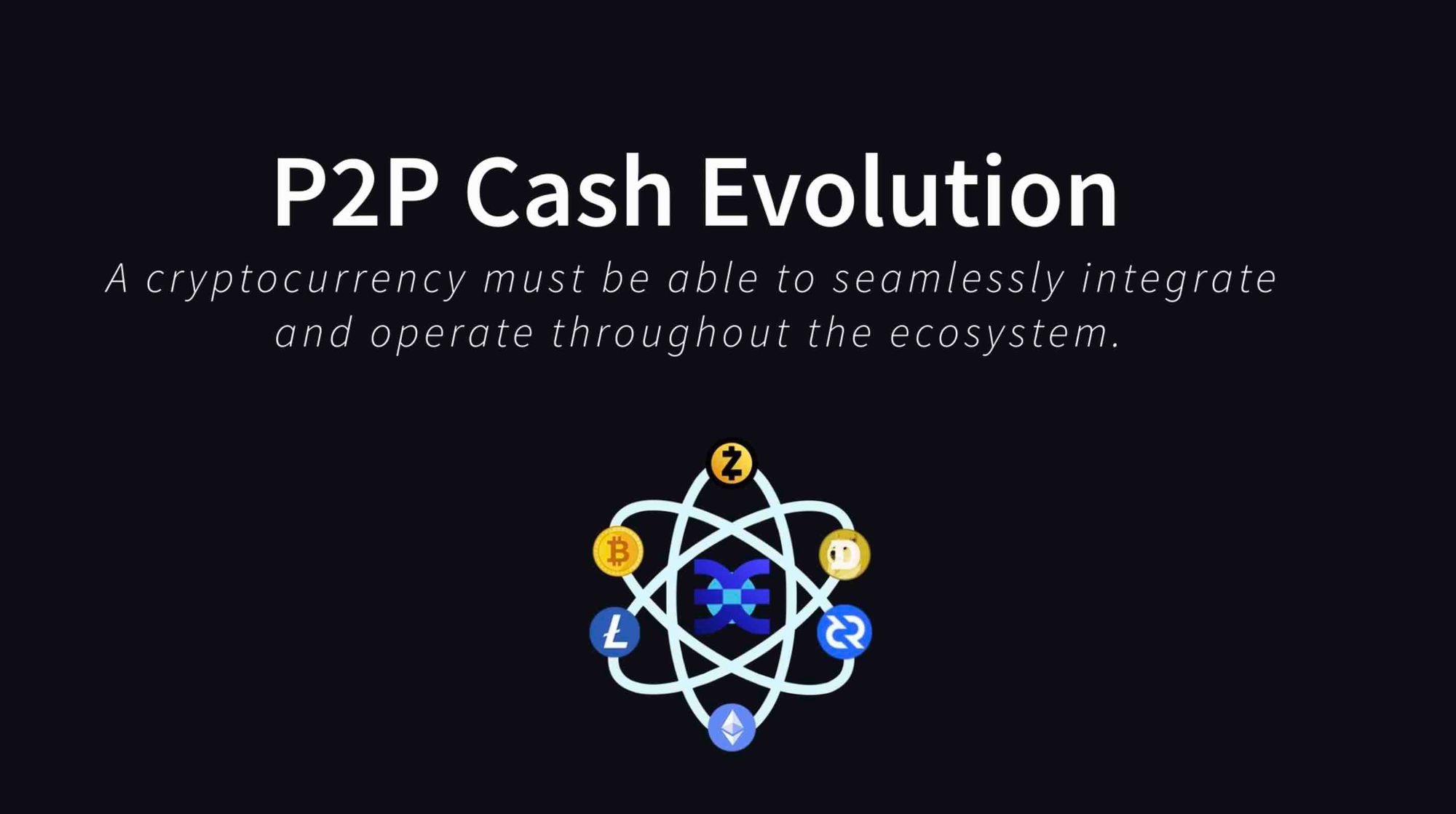

In Decred’s case peer to peer cash was just the beginning, this idea must evolve, to be better than what came before. A modern cryptocurrency must be able to seamlessly integrate and operate throughout the crypto ecosystem. The future is Decred! The future is P2P exchange.

LISTEN TO THE PODCAST:

To understand why a cryptocurrency would need its own exchange, we first need to understand the underlying nature of and how the market disadvantages projects acting in the best interests of its users.

The principle of peer to peer cash is to simulate physical currency in the digital age (e.g. paper notes and coins). The idea of being able to send and receive money freely without a middle man taking a cut of every transaction is how money should be. For instance, I want to buy an item for £1 and the person selling the item gets £1. Simple!

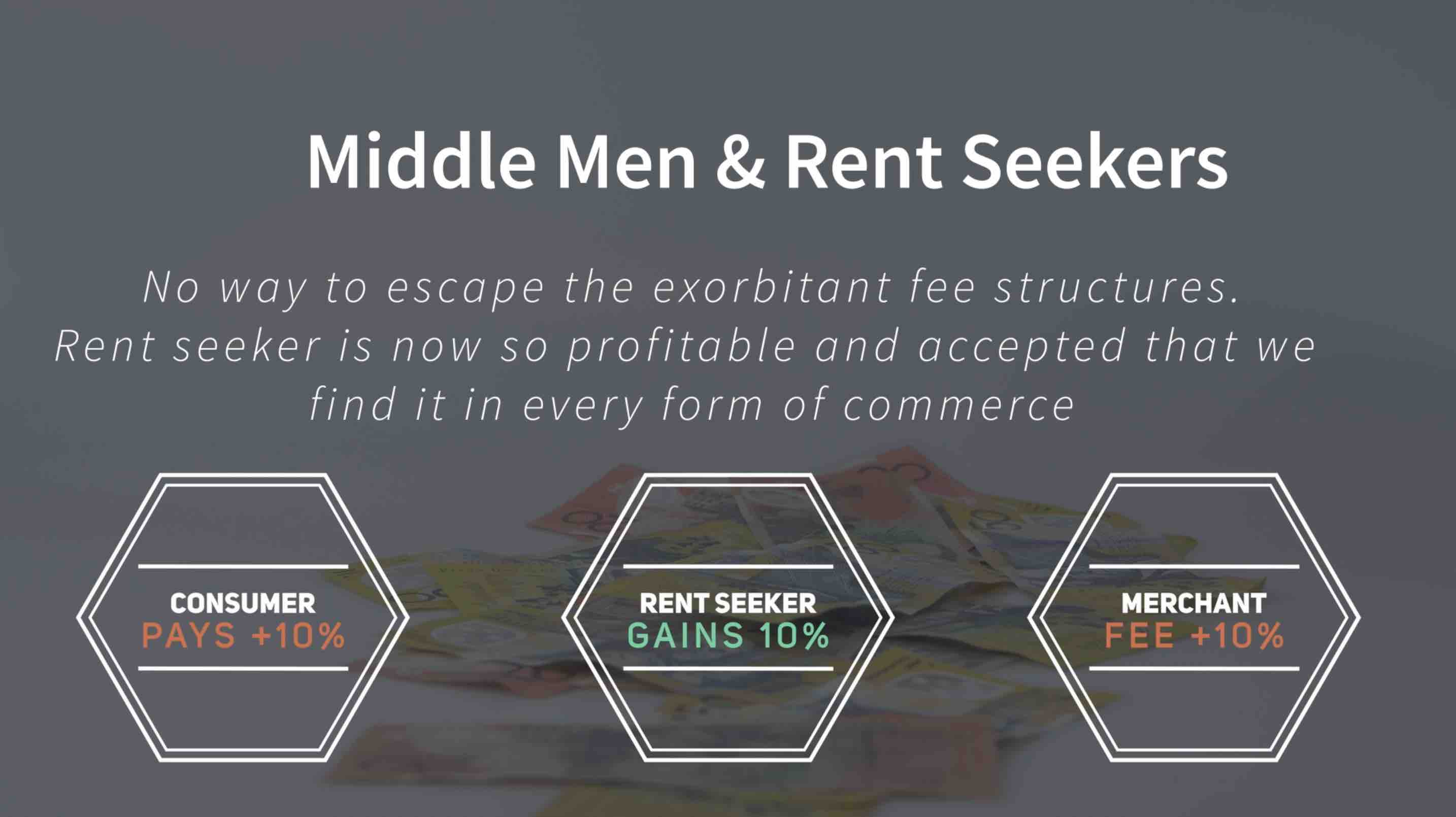

Most consumers don’t appreciate, merchants incur additional charges for each transaction, between 1% to 10%. Meaning, from a £1 transaction they get £0.90 and £0.10 goes to an arbitrary entity. From the consumer's perspective this may seem irrelevant, not their problem, until they realise this fee has actually been passed onto them.

In the time of cash, before credit and debit cards and fintech, both the merchant and the consumer could benefit and avoid a multitude of fees. On the other hand, the main reason credit and debit cards became so popular in the first place was because of fraud and theft. In this instance, the merchant was more than happy to pay the fees for the added protection. However, over time, this has become the standard with no way to escape the exorbitant fee structures of the middle man. The sad fact is, being a rent seeker is now so profitable and accepted that we find it in every form of commerce, from food delivery to paying for parking. Every service now has a secondary middle man collecting fees, all of which, will inevitably be passed onto the consumer.

Common transaction example

Let’s take car parking as an example and look at the process for completing the transaction from start to finish:

Example: Parking for 1 hour = £2.10

- The Ringo App charges £0.20 for their service

- Credit card provider charges approximately 10% (£0.20) + minimal service charge of £0.20 for their service

- The Car Park owner’s actual charge for parking is £1.50

For any given service, you are now paying a minimum of three different entities to complete the transaction, and this is before VAT and other Taxes. When you consider this as normal practice the likelihood is, this will only get worst over time.

What does this example look like when using a peer to peer system?

Example: Parking for 1 hour = £1.50 (DCR variable price approximately 0.065dcr)

- Miner fee for processing transaction = approximately 0.0002dcr (currently approximately £0.05)

- The Car Park owner's actual charge for parking is £1.50

- Consumer pays £1.55

It’s also important to note this transaction is done on-chain, it becomes even more affordable and efficient if processed on a layer two solution.

Perceived limitations of Peer to peer cash

Let’s look at the perceived limitations of peer to peer cash from both sides of the transaction. The first problem, peer to peer cash, presumes that both parties own and use the same currency. As long as both the consumer and merchant have a wallet, they can exchange goods or services for cash with no middle man. But what happens if both parties prefer different currencies? This is where exchanges come into play, currently centralised exchanges act as yet another middleman. A peer to peer alternative would be, a non custodial, peer to peer, fee-less DEX, that aims to remove this middleman whilst allowing people to transact with the currencies they prefer.

Another issue, at this time, the majority of people don’t have peer to peer cash or cryptocurrencies. So, they find themselves in a position where they have to buy some to transact. For most people, this is an arbitrary event, as we don’t usually buy cash. More often than not we’ll either work for it, be given it, borrow it or have it in reserve. In order for peer to peer cash to be taken seriously, the ecosystem needs to evolve to facilitate all four of these methods. To a certain degree, this has started to happen, but once again, in some cases, the rent seeker has returned to act as the trusted middle man. To avoid this situation, we have to maintain the ethos of developing noncustodial solutions, where the consumer and merchant never hands over control of their money to use a service.

Another contentious point, in peer to peer currencies, is miner fees. This fee is applied on the consumer side of the transaction, this can be quite disconcerting for the buyer, as in our previous example it’s the merchant that incurred the fees. Consumers don’t understand this, so they see it as less efficient than the existing systems. Another issue here is, the fee isn’t fixed. This can also cause some anxiety, especially during times of network congestion, where fees can be more expensive than the item being purchased. It’s for these two reasons that consumers and merchants are likely to use multiple currencies, and will likely want to exchange in and out of them at beneficial times.

My last point, about the perceived limitations of peer to peer cash, is, the price is not the price. The value of cryptocurrencies changes so frequently that it can be difficult for consumers and merchants to comprehend how much they are paying. Although, I can see a time when people are happy to buy and sell using cryptocurrencies. I think it will take a lot longer to get to a point where they don’t need to see the item priced in their local currency.

Why build Decred DEX (DCRDEX)

All of which brings me back to my initial point of why does a cryptocurrency need its own exchange. In Decred’s case peer to peer cash was just the starting point, this idea must evolve, to be better than what came before. Custodial / rent seeking services must be removed from every part of the system. A cryptocurrency must be able to seamlessly integrate and operate throughout the full ecosystem. The result should be a fluent experience for the user, to the point that transacting with peer to peer cash will be a better, more versatile experience for all participants.

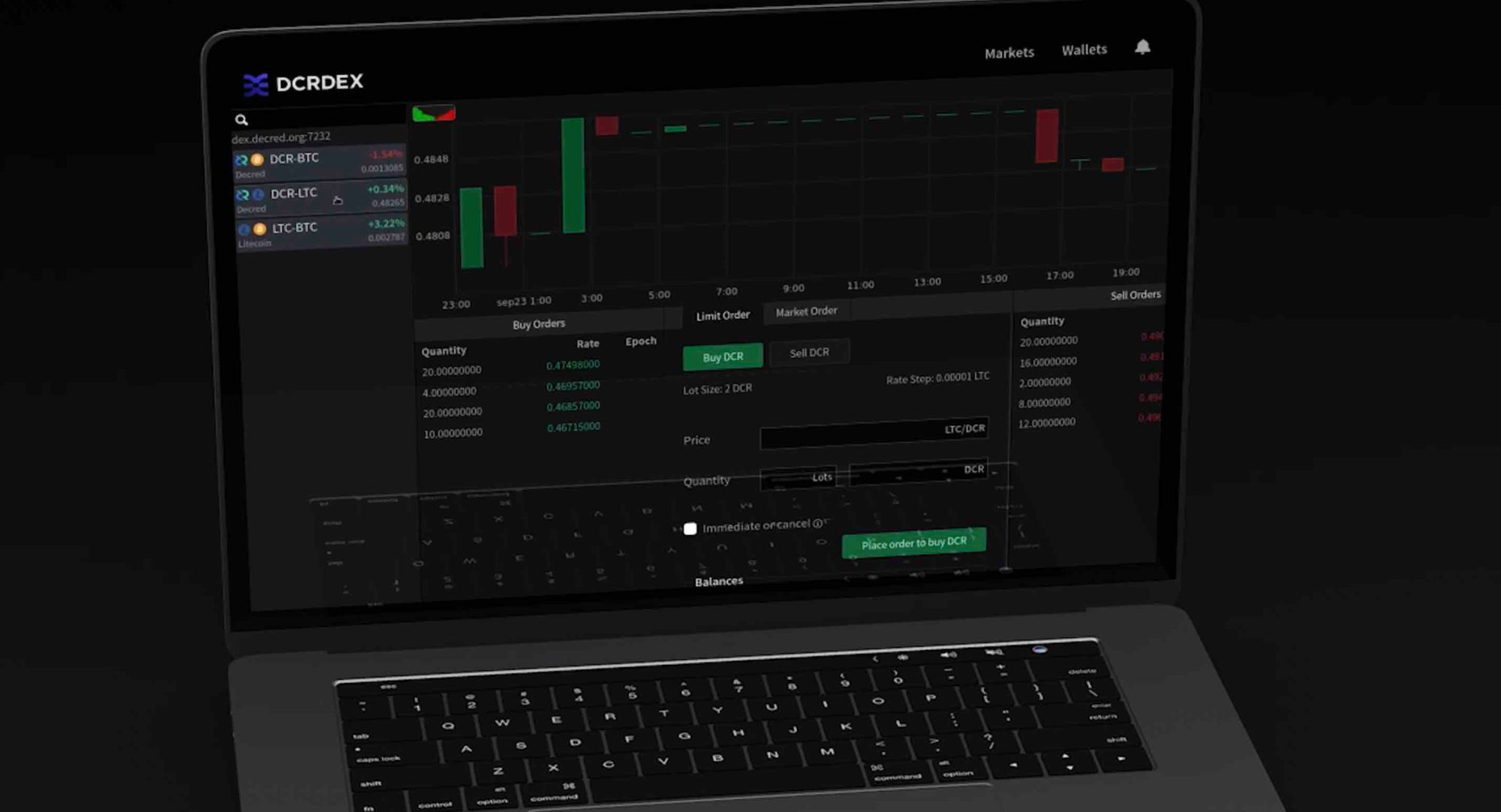

A benefit and drawback in Decred’s short history is, exchanges don’t want to list Decred DCR. This has been a thorn in Decred’s side, but it has also given rise to a thought process that believes it’s imperative for Decred to make its own markets and exchange, to survive. By having its own exchange, Decred has direct access to all markets and fiat on and off ramps. With just one simple pair, DCR/BTC Decred can move seamlessly between cryptocurrencies, exchanges and fiat currencies in all regions of the world without needing anyone's permission. As time moves on, pairs and liquidity will also grow to provide even greater opportunities. As a prime example, after only two years of being active, Decred’s exchange already has the second most popular DCR / BTC pair in the space.

Decred no longer has to worry about being listed on an exchange or being delisted from an exchange. Instead, it can focus on building better non-custodial technologies that continue to remove rent seeking middle men.

It’s for this reason, atomic swaps is used in Decred’s exchange. Through this technology, which was also built by Decred’s development team Company 0, coin holders never hand over their coins to a third party.

DCRDEX is an evolution of peer to peer cash that facilitates peer to peer exchange. Being an interoperable currency is the next evolution of peer to peer cash. DCRDEX is Decred’s bridge to the wider space, giving its users the financial instruments needed to exchange freely.

Decred’s Decentralised Exchange DCRDEX has many unique features to make it stand apart from all others, including:

- No fees for trading or exchanging between coins.

- All trades are completed peer to peer

- No High-Frequency Trading, which reduces order-book manipulation

- No KYC, all trades are permission-less

- Non Custodial, The exchange doesn’t hold your coins at any point in the exchange process.

- The exchange was built and funded using Decred’s treasury. All of which was approved by Decred Stakeholders.

To use Decred's Decentralised Exchange DCRDEX either download the Decrediton wallet which is the most convenient for new users or download the latest version as a standalone piece of software:

- Download the Decrediton Wallet - https://decred.org/wallets/

- Download the DCRDEX software directly - https://dex.decred.org

Set up a Litecoin wallet in DCRDEX 0.5.3

Comments ()