U.S. government holds a lot of Bitcoin! Is this a problem?

The sheer size of the government's reserve means that any announcement, action, or decision related to its BTC will have extra attention from the market.

According to the latest report from The Wall Street Journal, a noteworthy and potentially concerning situation has come to light: The U.S. Federal Government possesses a substantial amount of Bitcoin, valued at approximately $5 billion. This estimated sum consists of a total of 194.188 BTC, primarily stemming from government seizures carried out against specific targets.

The situation seems surprising to many since the U.S. government has recently conducted a regulatory siege against the crypto market. This regulation effort has created a situation of apprehension and uncertainties amongst investors. After this report, it's possible to see that Bitcoin is not that uninteresting to the U.S. government, most of the stock holdings are primarily kept offline on encrypted cold storage devices known as hardware wallets. These devices are entrusted to the U.S. Department of Justice and the Internal Revenue Service.

Where did the BTC come from?

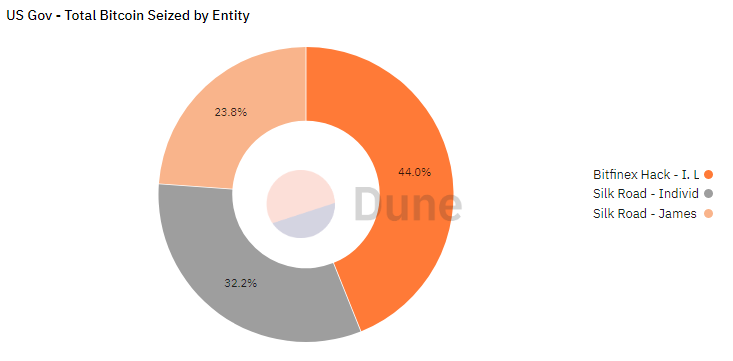

This large amount of BTC under the U.S. guard is the result of several operations and crackdowns on darknet platforms and so-called (by them) fraudulent activities.

One remarking instance involved the response to the Bitfinex cyber attack, a comprehensive effort that spanned almost six years. This operation culminated in the Justice Department obtaining a substantial quantity of Bitcoin (94.643 BTC). Furthermore, the well-known closure of the online darknet marketplace Silk Road in 2013 presented the opportunity to confiscate many bitcoins (69.369 BTC).

After the seizure of Bitcoins, a legal procedure unfolds, often extending over multiple years. Once the legal matters are resolved, the responsibility for liquidating these assets falls to the U.S. Marshals Service. Initially, auctions were the preferred strategy. The current approximation of 205,515 bitcoins (BTC) is derived from a collection of metrics within Dune Analytics, which was developed by 21Shares, an exchange-traded product provider. This data provides insights into the U.S. government's addresses and their transaction history.

Why this may be a problem?

While some may interpret the U.S. government's substantial Bitcoin holdings as a vote of confidence in the cryptocurrency space, it's essential to recognize that there are significant drawbacks to this scenario. The magnitude of their BTC holdings provides the U.S. government the ability to exert a considerable influence on the market.

Centralization

One of Bitcoin core fundamentals is its decentralized nature. It was designed to be a peer-to-peer borderless, and censorship-resistant project. If an entity, especially a government, holds a large amount of the BTC supply, decentralization is undermined. The risk of network manipulation by this entity grows, leaving small investors powerless over their influence.

There is also the concern of investors losing confidence in the project, since many may be worried about the government's intentions and how they might influence the future of the network development.

Price Interference

Large holdings of one coin can be potentially used to manipulate the market. The U.S. government's actions with its BTC holdings could lead to price volatility or even crashes if they decide to sell a significant amount at once. The sheer size of the government's reserve means that any announcement, action, or decision related to its BTC will have extra attention from the market.

Moving Foward

Bitcoin is now going through an excellent period, its price has gone up over 30% in the last month, meaning that we can have a crypto bull run in the next months. It remains to be seen how the U.S. government will behave, and how its involvement in the crypto market will evolve. Do you think this involvement is good for the market? Leave a comment below!

Comments ()