The early days of the Internet were magic: the possibility of an emergent global, decentralized society that transcended nation-state borders and where people could share data freely.

It was the province of the technically savvy and academia back in those days. Up until the so-called Eternal September in the early 1990s, which pushed it to the mainstream and, as new technologies usually tend to, resulting in the dot com bubble, from which the Web 2.0 was born: today’s digital neofeudalism of Facebook, Google and Silicon Valley Big Tech.

The subsequent emerging paradigm of decentralized and peer-to-peer crypto which arrived on the scene with Bitcoin and was, again, pushed from the fringe to the mainstream via a series of micro bubbles and the mass 2017 pumpathon, is in many ways reminiscent of these early days of the Internet, characterized by speculations about a hyper-connected world and futures-to-be.

Bitcoin was essentially a rogue money vehicle, an unregulated sideway alley for capital flows, a means for doing commerce online that was outside the jurisdictions of traditional and legacy frameworks and structures (and, as such, very libertarian in spirit, resonating with the general political attitudes of cypherpunks and hackers throughout the 90s and early 2000s). More of an ad hoc heuristic or a very clever hack itself, Bitcoin replicated some economic principles of its working, artificially creating digital scarcity and game theoretic alignment of actors’ incentives.

Somewhat similar in its conception, underlying assumptions, and even aesthetics to those of the neo-reactionary movement and the Urbit project, Bitcoin likewise stands out with its conservative simplicity of functional constraint and purpose (as something of a reliable Schelling point, a basic primitive “coinage” economy which could only outsource further complexity, but not change its fundamental standing).

All of which had probably been necessary as means to demonstrate the technical possibility of representing real-world value as circulating within a decentralized network without any central point of managerial control (and thus, failure) or direct human intervention.

Such a medium should in time enable tremendous increases in allocative capital efficiency and precision. Bitcoin certainly did pick the right moment to arrive on the scene and ride the historical momentum in the aftermath of the 2008 economic crisis.

As we’re entering another economic crisis, it’s time to reflect on that event once more.

This event has since given rise to a lot of theorizing about how to adequately model and design efficient self-regulating markets (or re-discover the Invisible Hand) - since, as 2008 revealed, financial capitalism has come to a level of abstract complexity that can spiral out of control and of our being able to effectively manage such organizational complexity (all the while applying beliefs and axioms about the market which no longer apply and appear to be more ideologically rooted than theoretically grounded in any reference points to reality in motion).

Reimagining Money

Let’s go back a little though: what is money to begin with?

A simple answer would be free-floating debt abstraction of a universal equivalent of measure between things, such that it enables the trade of goods between strangers who otherwise neither know nor trust each other. One of the things traded is also labor, so money also serves the function of allocating productive work. Price, on the other hand, serves as an information system to communicate supply and demand: what is in oversupply and what requires more production. Thus, money is better understood through the lens of information theory (a line of thinking that was developed in Hayek’s work).

When the gold standard was abandoned in the early 1970s though, this debt was embodied in trust in the American economy (thus, fiat, let that be so) - which, in turn, gave the State the power to generate this debt abstraction directly at the press of a button, without there being anything to justify or back it. That way, basically borrowing from the future in betting on the repaying of that debt sometime in that murky, uncertain future. This in turn creates a hyperactive society that has to constantly expand in order to pay for the past debt in the future.

The Challenges Facing Bitcoin

Enter Bitcoin - peer-to-peer cash with fixed, predictable supply, but not really fungible, since the ledger keeps tamper-proof audit trails of the coins - making it possible to blacklist some, and also it is often that older coins are worth more than newly minted ones. (Hence, the Bitcoin maximalist meme “1 BTC = 1 BTC” is not literally true, regardless of the seeming tautology.)

Unlike electronic fiat, however, there would be scalability issues with Bitcoin if mass adopted - not to mention the constant looking threat of mining centralization in autocratic jurisdictions such as China in the past (thus, also having a geopolitical component to it).

Some cryptocurrencies have emerged in order to try to iterate on Bitcoin’s general idea, addressing some of its shortcomings: Monero, for example, is thought of as what Bitcoin was supposed to be, in the sense of how it is anonymous, untraceable, and ASIC-resistant in its “egalitarian” CPU-only Proof-of-Work.

In general, the enterprises and undertakings which developed after Bitcoin were (and still are) mostly advancing and re-purposing the general concept of the consensus-driven blockchain (e.g., Ethereum’s equipping it with a code execution environment for running more complex operations as stored in code on the blockchain itself, etc.)

Attempts at iterating Bitcoin can be sorted out in a number of categories, for example:

- PRIVACY: Monero, Decred, ZCash, etc. - involving sophisticated cryptographic protocols which are the ones most “cypherpunk” in nature.

- SCALABILITY: Mimblewimble (such as Grin, BEAM) - and Lightning Network

- Prevention threats presented by PoW mining centralization and cartel-forming: Monero (with ASIC-resistant RandomX), Decred’s hybrid PoW/PoS are different approaches to combat miner centralization (especially with its recent move to increase the reward ratio)

These are all specific areas of improvement - but there are also more holistic, systemic issues that plague Bitcoin that are often overlooked by the Bitcoin community. Initially conceived of as a fully decentralized system, Bitcoin nonetheless has come to exist and operate within an ecosystem of centralized and siloed entities and services which, consequently, pose the threat of re-centralization and capture. Decred itself takes the general premise of Bitcoin in yet another direction and it constitutes a DAO of stakeholders which vote on proposals and make decisions (e.g., controlling budget and policies to make the currency more adaptable) with their stake in the system (and thus, are directly incentivized to increase their value by increasing the value of the system that secures it). Decred is designed so that it would reduce or eliminate conflicts of interest and chain-splitting hard forks by aligning the incentives and interests of network participants and actors. Decred has major aspects of governance directly baked into the protocol, strong focus on community input and sustainable funding and development in mind.

Decentralizing the Whole Ecosystem

“I’m tempted to say decred is the best bitcoin” - Chris DeRose

Bitcoin exists within an ecosystem of overlapping and interwoven re-centralization tendencies whose governance and trajectory of development is driven by traditional corporate structures such as Blockstream. Practically, Bitcoin is mostly bought and traded through custodial brokers and centralized exchanges which require personal identification and passing KYC/AML procedures. That in itself in many ways defeats the purpose of what Bitcoin was meant to fulfill (as there is little point in trading a decentralized asset on centralized exchanges, except as simulating market dynamics in its legacy form). Not to disregard or diminish what Bitcoin has contributed in its pulling the distributed peer-to-peer paradigm of decentralization from the fringe and into the mainstream, but rather asking if bitcoin could be made even more bitcoin-like in line with its early day ethos.

Here's a quick sketch of how the ecosystem operates in its current consortium-like form:

What if the centralized entities could be replaced with decentralized ones? And decentralized assets circulate within a decentralized ecosystem composed of loosely coupled independent subsystems resistant to capture, protecting it from re-centralizing effects.

This is what Decred, one such undertaking in the cryptosphere aims to accomplish. An analogy could be drawn in how there are many various distributions based on the Linux kernel which is itself free but surrounded by proprietary software, whereas Decred is more like a BSD system where the kernel, the distribution, and all packages exist as a single whole and are free software (free as in free speech, not free beer).

And it is under such circumstances of decentralization and the flexible properties of the relationships between the parts in the system which set the conditions under which emergence appears. Decred is an undertaking pushing towards such an alternative to the whole "operating system" of corporations in setting up something much more resilient and robust in the sense of a complex adaptive system.

From Cryptocurrency to Cryptocapital

We should either accept bitcoin within an ecosystem of centralized entities under the constant threat of capture or push things further in the other way to try to decentralize the whole ecosystem in our efforts to build an operating system for a different kind of market (and/or other kinds) economy. Ambitious, perhaps even grandiose, but given the current state of affairs, absolutely necessary (and the proverb says, necessity is the mother of invention).

We look at Decred as a form of organization, or what is more commonly known in the space, a decentralized autonomous organization (DAO) - an electronic peer-to-peer corporation (in lieu of Satoshi's "peer-to-peer electronic cash").

While left-wing criticism of capitalism, alerting us to the inequality existing in society today is pertinent, even though their solutions, ranging from the centrally planned economy of state capitalism to nowadays more inauthentic lumpen alt-left shouts to "eat the rich!". These do have a lot of resonance in terms of the reality of those issues we're facing, the solution however must be in universalizing the tremendous productive potential of capital and channeling its productive capacity towards social good.

In Decred's vision of a digital economy, users, workers and customers altogether benefit from the growth of value accumulated in the network itself as the functions of currency and capital are joined in working together (rather than divorcing price from value). Much of the dissatisfaction in society today is to do with the lack of access to the means of production and the alienation which follows from not being directly involved in the creation of value (but having to sell one's labor).

We’ve come to generally associate corporations with unscrupulous profiteering and as something malignant or even evil, overlooking its raison d’etre as a general organizational concept. The Industrial Revolution, as any technological revolution does, changed how labor is organized and tremendously accelerated productivity thereby. Likewise, today’s technological revolution enables the functional re-purposing (or “deterritorialization”) of old concepts in new contexts, often leading to them changing in nature.

But what was the true "revolution" in the Industrial Revolution? It was the magic moment when the British government decided that they would grant second-order sovereignty to companies and create a legal entity whereby a group of people could be aligned, with common capital and people working for it within a legal structure. Before that, people were basically limited to small groups of people that could trust each other. And now suddenly there was this entity that could glue people and capital together with an incentive structure where everyone’s incentives were in line.

So this one innovation by the British government enabled that incredible boom in terms of not just coming up with inventions, but making them great and getting them into people’s hands. It's still underappreciated how valuable that was. The most important “invention” of the industrial era was not any specific tech invention, but the “meta-invention” that accelerated all other inventions; this can also be called incentive alignment, and it’s the thing Decred seems to get right. What generated the tremendous pace of advancement in the Industrial Revolution was a form of incentive alignment that allowed people who otherwise do not trust each other to work together for the same goal. However, Decred does this in a decentralized way and not through a State imposed fictitious person, which is crucial.

We feel as if these entities, called corporations, have, due to their acquired legal entity status, begun to become the principal “subjects” driving history forward. It is as if they had intelligence and an agency of their own. One of the pioneers of the field of artificial intelligence, Professor Stuart J. Russel, has recently gone so far as to describe corporations as artificial intelligences that have taken over.

“[...] we don't have to look forward to a time when AI systems take over the world: they already have and they’re called corporations. That corporations happen to be using people as components right now, but they are effectively algorithmic machines and their optimizing an objective which is quarterly profit that isn't aligned with the overall well-being of the human race [...] that's one way of thinking about what's going on with we corporations but I think [...] that there are there many systems in the real world where we've sort of prematurely fixed on the objective and then decoupled the machine from those they’re supposed to be serving and I think you see this with the government. Government is supposed to be a machine that serves people but instead it tends to be taken over by people who have their own objective and use the government to optimize that objective regardless of what people want.” (Professor Stuart J. Russell, on the AI Podcast with Lex Fridman, Dec 9, 2018, ~46:50)

Professor Stuart J. Russell uses the analogy of “algorithmic machines” running on wetware to point to what he sees as two problems with the, let’s call it, government-corporation complex:

1. a premature fixation of objective (quarterly profits);

2. the “machine” becomes “decoupled” from those it was originally meant to serve.

Since corporations exist within the legal framework provided by the government. The corporation has to optimize its objective, and sometimes this leads to behaviors that are taking advantage of the “glitches” of the environment (using tax loopholes, etc.) In this way of seeing things, we eliminate any moralistic language (“corruption, evil”...), and see aberrations in a purely systemic way: we recognize the same set of problems, but we have a better shot at actually developing alternatives to solve them. Moralism is ineffective and should be replaced by systems thinking. “Don’t be evil” should be replaced by “can’t be evil”.

We should see the corporation as a step forward from the close-knit group of friends who trust each other and run a business together based on trust, to something that can scale better. Such groups, or families, can of course collaborate without having to use any special organization, but this model cannot scale. In order to scale, we need something like a corporate entity. Without it, strangers could not collaborate and capital could not be joined with labor to accelerate progress.

The problem with the traditional corporation is not where we would assume to find it. It is not that there is a need for more regulation. It is that the very regulations accelerate the problems because these “artificially intelligent” corporations learn to evade them, while the average Joe cannot afford to do the same. What an “electronic peer-to-peer corporation” is able to do, is to circumvent this duality between the state and the corporate, and create an entity that gives the stakeholders direct power (not delegated). A user can also be a stakeholder and can also be a member of an anonymous global “board of directors”. In the traditional corporate framework, the fragmentation between these aspects causes a chasm between what users want, what shareholders want, and what the board of directors wants.

Uniting Currency and Capital

A personal recollection: I remember that while employed at a regular job I didn’t like too much, at a small company, I was actively desiring the company to have just enough business not to fail. If it had too much business, I would have to work more, but for the same pay. If it had too little, it could risk closing and I would lose my job. But isn’t it evident that there’s something wrong with this picture? Wouldn’t I feel differently if I was receiving a stake in the company?

The misaligned (or perverse) incentives and the quantitative medium through which the value of workers’ labor is valued and exchanged leads to what Marx termed alienation. But if currency and capital are coupled as instruments of direct participation (in some such digital cooperative corporations) in both the work and its fruits and outcomes, then that would better ground motivations and psychologically enable different modes of coherent economic behavior.

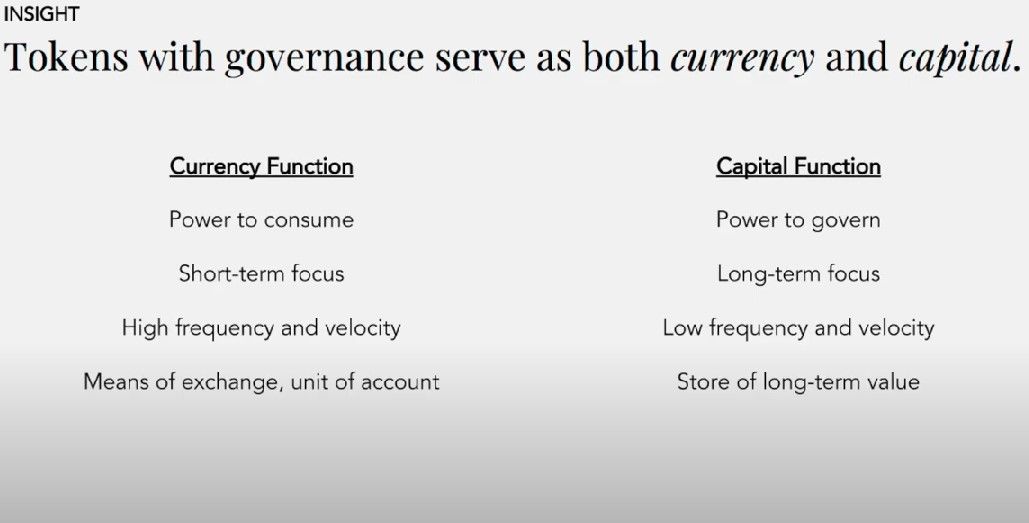

The key to achieving this new type of organization and what it would mean first became clear to me when I read Joel Monegro of Placeholder VC’s remarks, it was a veritable eureka moment (link to a video presentation of his ideas): governance in crypto allows for the emergence of something more than “currency”: it allows for the emergence of crypto capital. And what is capital? Simply put, capital is the power to productively organize labor and mobilize the means of production toward the desired outcome.

“Separating currency and capital leads to concentration. Modern capitalism keeps currency and capital separate. Capital appreciates over time while currencies depreciate in time, leading to a massive concentration of wealth and power.” (Joel Monegro, 14:15)

What something like Decred makes possible then is the above mentioned “superpower” of formal incentive alignment, but without having to exist within a legal framework that depends on extensive institutional bureaucracies and specialized human expertise to run it (and therefrom, being cumbersome, often inefficient and susceptible to outside influences, lobbying, human error and bias).

It’s naive to see the rigged game situation of the current economy solely in terms of “corrupt individuals” and “bad apples” - instead, the systemic reasons that condition and underlie this state of affairs much be looked at more closely. A corporation, by definition, works to optimize its “reward function”, which is usually defined in terms of quarterly profits - and as such, it has to use all the means available to it towards that goal. So, it’s only rational to employ lobbying, various ways of evading taxes, etc.

In Decred, the functions of currency (as a unit of accounting and means of exchange) and capital (as the capacity to productively organize labor) are coupled together - those working for the Decred ecosystem, for example, are paid in the system’s native token, which is also used as voting stake, allowing the holder to participate in the decision-making processes which set the course for future development. Thereby making stakeholders directly responsible for the outcomes of their choices, decisions, and actions, instead of delegating those responsibilities to a central bank, government institution or some panel of narrow experts (whose interests may not always coincide with those of the people they are expected to represent and act in the interest of and who too often do not carry the burdens of the kinds of risks they might take).

“Separating currency and capital leads to concentration. Modern capitalism keeps currency and capital separate. Capital appreciates over time while currencies depreciate in time, leading to a massive concentration of wealth and power.” (14:15)

While agreeing with the left-wing critique of modern-day financial capitalism and the disproportionate asymmetries of inequality it creates, the solution may lie in the coupling back of price and value, currency and capital, rather than in stricter and more crippling regulations, cumbersome bureaucracies, and increased state intervention.

“Most people live their lives in currency, and few people live their lives in the capital. Currencies tend to lose value in time, while capital tends to appreciate in time. ” (15:00)

At the time of writing this, we are witnessing unprecedented division in society. The division is usually described as the divide between the Left and the Right, or the have and the have-not, the socialists, and the capitalists. But this battle is fought within the system that created it, instead of outside of it. This system, corporatism, will not be overcome by anarchy or by rage, but by something that is as effective, as productive (if not more) than the corporation, but without its deadlocks. It seems to me the idea of uniting currency and capital, stake and wage, and skin-in-the-game with sovereignty steps in a direction that satisfies both sides, and creates a self-directed, autonomous collective that can collaborate across borders.

Now try to imagine how a society runs on this “operating system”, instead of the corporatist one. I feel drawn to this vision.

Comments ()