Decred Finance 2.0

I, like so many others, have the ambition to become self-sufficient and believe that no able person should rely on a government or company…

I, like so many others, have the ambition to become self-sufficient and believe that no able person should rely on a government or company to determine their future. It’s, for this reason, I work hard and try to put as much money aside as possible for mine and my families future. Over the past few years, I have noticed one disturbing fact, no matter how hard I work and no matter how much I try to save money I always start the next financial year with close to zero in my bank account.

It occurred to me that my relationship with money is not healthy. It’s like I have an auto self-destruct mechanism that activates every time I have a little extra money and no matter how much I earn I always have to spend it or pay for something unexpected or overreach to get that next big item and take on more debt.

It’s for this reason that I started to research different areas of investment, as an alternative to putting my money into a low yielding savers account. I looked at traditional investments and read a lot of books that made me think that the brokers who would be in charge of my money are not the most trustworthy of individuals and would most likely invest my money against my best interests. Also, being of the mindset that I would like to be self-sufficient I believe that it is in my best interest to understand how these financial systems work and make decisions based on my risk assessments. As a final note, through this research, I also discovered that I’m interested in coins and collectables e.g. silver and gold coins with fancy designs, and I have little interest in companies and commodities.

This led me down the rabbit hole of Cryptocurrencies and the theory of becoming my own bank and investing in highly volatile and speculative assets. I found that the narrative of “the banks are broken and we need to take back control” resounded with me through my own experiences.

Cryptocurrencies are not perfect and there are a lot of bad actors in this space, just like traditional financial systems. However, because this space is so young I feel strangely optimistic that it has the opportunity to make a big difference to the world and if successful could make a much fairer monetary playground from everyone to participate in.

So with this in mind, I would like to share with you the investment strategy that I have developed to help me make better decisions. This has guided me away from getting caught up in all the hype and market manipulation but please keep in mind this is a work in progress and very much based on the current cryptocurrency environment.

Building an investment strategy in the cryptocurrency space.

There are lots of really bad projects in this space looking to take your money and although it’s impossible for me to determine each of these projects there are a few simple rules that you can follow to help you avoid losing your money needlessly.

Fiat to crypto onboarding — This is the point that you will lose a lot of your money before you even begin. When you exchange from normal money to crypto you normally have to go through an exchange and most of the exchanges for consumers have the worst exchange rates and the highest fees. EXAMPLE: To convert £100 on Coinbase to BTC will cost £3 in fees and you will get the price set at the current market value minus the spread. This full transaction will cost you approximately £5 when the exchange is completed. To save money here move your funds from Coinbase to Coinbase Pro where you can set the value you want to pay and the fees would be £0.50 for every £100 converted.

Study the charts — The word FOMO applies to every new crypto investor and it refers to your state of mind and the fear of missing out. If you study the charts and you are patient you will find a better entry point than the one on offer. This combined with learning Coinbase Pro will save you a lot of money in the long run. If I had known this when I started I would have saved 50% of my initial investments and made a further 20% by year-end. On average the main cryptocurrencies have an oscillating correction approximately every 90 days. Coin Market Cap is a good place to start as the charts are the most up to date in this space but not perfect.

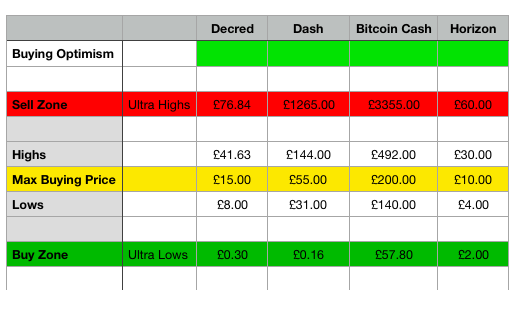

Price range — You need to understand the average price range of a project over the course of time. This can help during times that crypto projects are overpriced through promotion and common pump and dump actions. Understanding Buying and selling zones will help you make better investments and make your money go further. Control your emotions the price will bounce back over time.

Stay away from tokens — Crypto tokens and crypto coins are two different things. Tokens are built on top of a platform and crypto coins represent a platform. Crypto tokens in future years could be a good investment but at the moment they have two risk factors the token project its self could fail and the platform the token is built upon could fail. In this instance, you are probably better off investing in the platform.

21 Million Coin Max Supply — If a platform has more than a total supply of 21 million coins, ask yourself why? If there is no good reason stay away. Bitcoin has set a very good president in this area and I see no good reason why a project would need more than this amount of coins to fulfil the project requirements. Whether you like it or not 21 million is a massive number and also remember that a single coin can be divided up into 100,000,000 satoshis. Also, what is the likelihood that a project is going to be used by more than 1 million people let alone 21 million people!

It’s all in the percentages — If you are going to invest in a project try to buy a percentage, this will give you a visible portion of the control of a project. Do the math, how many coins do I need to buy to have a millionth of 1%. The answer with a maximum supply of 21 million is 21 coins. The next question is how much will this cost and whether you feel that this is a good investment for your money.

Exchanging for coins, not on main exchanges — Some of my coins are currently hard to acquire due to them not being on the main exchanges or not having adequate pairing options. One method I use to convert to and from these assets is an exchange called Changelly. This doesn’t give you the best exchange rate but until space matures it is currently my prefered method to get these rarer coins. A good exchange from Coninbase to any of the coins that I’ve listed is Litecoin (LTC) as it has low exchange fees and is quicker to complete the transaction than Bitcoin (BTC) or Bitcoin Cash (BCH).

No Keys, Not Your Coins — Once you’ve bought your coins get them off of the exchange and into your safe and secure wallet where you have access to your private keys. If the project has its own mobile and desktop wallet this is a really good reference that the project has true merit. If you have to use a multi-currency wallet to store your coins, see this as a bad omen and do more research before taking the plunge. Please note that depending on the project you invest in there are also mining fees to pay for transferring coins, try not to transfer too often otherwise, this could become costly. The projects I have listed all have relatively low mining fees for transferring and spending coins.

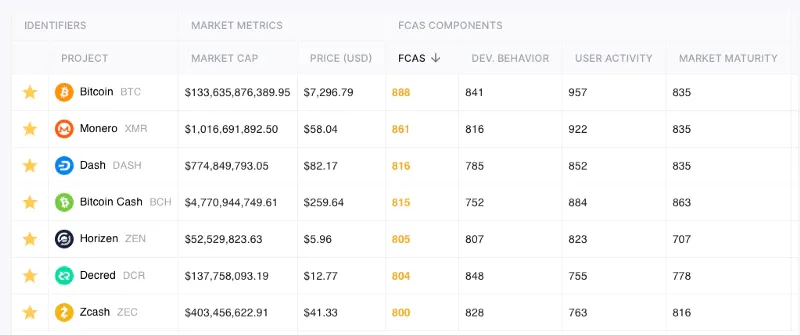

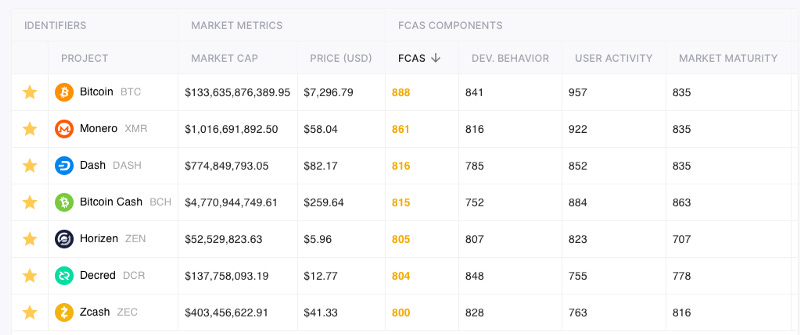

Project Development, Project Maturity and User Activities — One of the most valuable tools for beginners in the crypto space is https://app.flipsidecrypto.com/tracker/all-coins , this tool lets you analyse the overall health of a project. My theory here is to regularly check to make sure a projects FCAS score is above 800 and that there are no irregularities e.g. a high user score with a low development score.

Crypto to fiat offboarding — The final test is how cheap and easy it is to get your crypto to fiat or to use it in a real payment scenario. Once again this can be quite expensive if you use a consumer exchange but if you use something like Coinbase Pro you can convert them back fairly cheaply and then if you use Coinbase with a PayPal account you can get them off the exchange free of charge, else this part will also cost you.

Projects that currently have the most credibility and meet my investment strategy criteria, these are in preference order:

- Decred (DCR) — Current price £11 — price per 21 coins = £231

- Dash (DASH) — Current price £60 — price per 21 coins = £1260

- Bitcoin Cash (BCH) — Current price £209 — price per 21 coins = £4389 (This is a fork of Bitcoin Core and has a lot of negative publicity, which could be a deciding factor to the success of this project. I have a lot of respect for this project and the fact that the lead developers and promoters are willing to talk about the difficulties surrounding the Bitcoin projects.)

- Monero (XMR) — Current price £46 — price per 21 coins = £966

- Zcash (ZEC) — Current price £31 — price per 21 coins = £651

- Horizen (ZEN) — Current price £5 — price per 21 coins = £105 (currently I don’t hold this coin as it has no mobile wallet but is firmly on my watch list)

- Bitcoin (BTC) — Current price £5852 — price per 21 coins = £122,892 (This project has the first-mover advantage but is overpriced for most beginner investors and the development isn’t as progressive as some of the newer projects.)

My top pick from a year’s worth of investing in cryptocurrencies — From my current research, it is obvious that Decred is one of the most undervalued projects in the space. Decred is currently my number one hold and has the development and funding potential to become increasingly valuable as this space matures.

I hope this document helps you in your investment journey and it would be great to get your feedback and opinions especially if you have methods for reducing the fees occurred during these exchanges. As my journey continues I will produce more documents of my experiences to help inform and reflect on possible best practices.

Final Disclaimer — Please note that the above research is not financial advice and you should always do your own due diligence before investing your money. Investments can go down as well as up and cryptocurrencies are typically volatile assets.

The views expressed in this article are that of the author and based on the authors own research and investigation. The author is happy to receive comments, feedback, edits and likes for this channel to help evolve the open nature of the discussion.

DCR Donation Address: DsahjKtXPeMFqN5AXr3Vim5TMDYAGdhPKqj

Comments ()