Decred Decentralized Exchange: Creating a Fidelity Bond

With the release of DCRDEX version 0.6 the exchange moved from a registration fee to returnable fidelity bond.

DCRDEX is a new generation of exchange. Its standards are rooted in the cypherpunk movement of removing the middle man and facilitating peer to peer transfer. When Satoshi designed Bitcoin, they could never have known how quickly and ruthlessly the centralised exchange culture would undermine the principles of peer to peer cash by inserting itself as the over lord of digital money and digital assets. Every exchange goes through them, and they’re a massive wealth generator for the owners, “yet another middleman!”

In order for DCRDEX to be better and not just another middleman, every value extraction method has been removed. You might be thinking “but there are already many DEX’s why build another?” Because most of them are DEX in name only. Most don’t remove the middle man they replace them and insert themselves, greed and profit are massive motivators. To appear better, DEX’s resort to using discrete value extraction methods like:

- Front-running trades

- Exchange tokens

- Wrapped tokens

- Third-party liquidity providers

- Make / taker fees

- And a host of other schemes.

To correct this, DCRDEX has achieved the following goals:

- No trading fees, this includes both maker or taker fees

- No accounts, the software runs on the individual's machine and requires no personal information

- No KYC policy – because there are no accounts and no middleman, there is no requirement for “Know your customer” information

- DCRDEX is an atomic swap platform and as such doesn’t have or require a centralised multi-sig wallet to conduct trades. As we saw last year, multi-sig wallets are a giant target for hackers.

- No third-party trading tokens

- No wrapped tokens, all trades are conducted on-chain between blockchain projects

- An epoc timing system that stops trades from being front run

With the release of DCRDEX version 0.6 the exchange removed the last remaining fee associated with using the platform. This was the registration fee (0.1 DCR) needed to connect to a server and ensure good behaviour.

This has now been replaced with a fidelity bond which is no longer a fee but a returnable amount to ensure all users follow the exchange rules. The bond has to be locked continuously. If the user decides to stop using the platform, they can unlock their bond, which takes up to 60 days to fully unlock.

Fidelity bonds are a prerequisite to the mesh server, which is the next stage of DCRDEX’s decentralisation evolution. The mesh server will enable anyone to run a DEX server and the trading pairs of their choice whilst being connected to the global order book.

Let’s have a look at how the fidelity bond system works and how to cancel the bond when required.

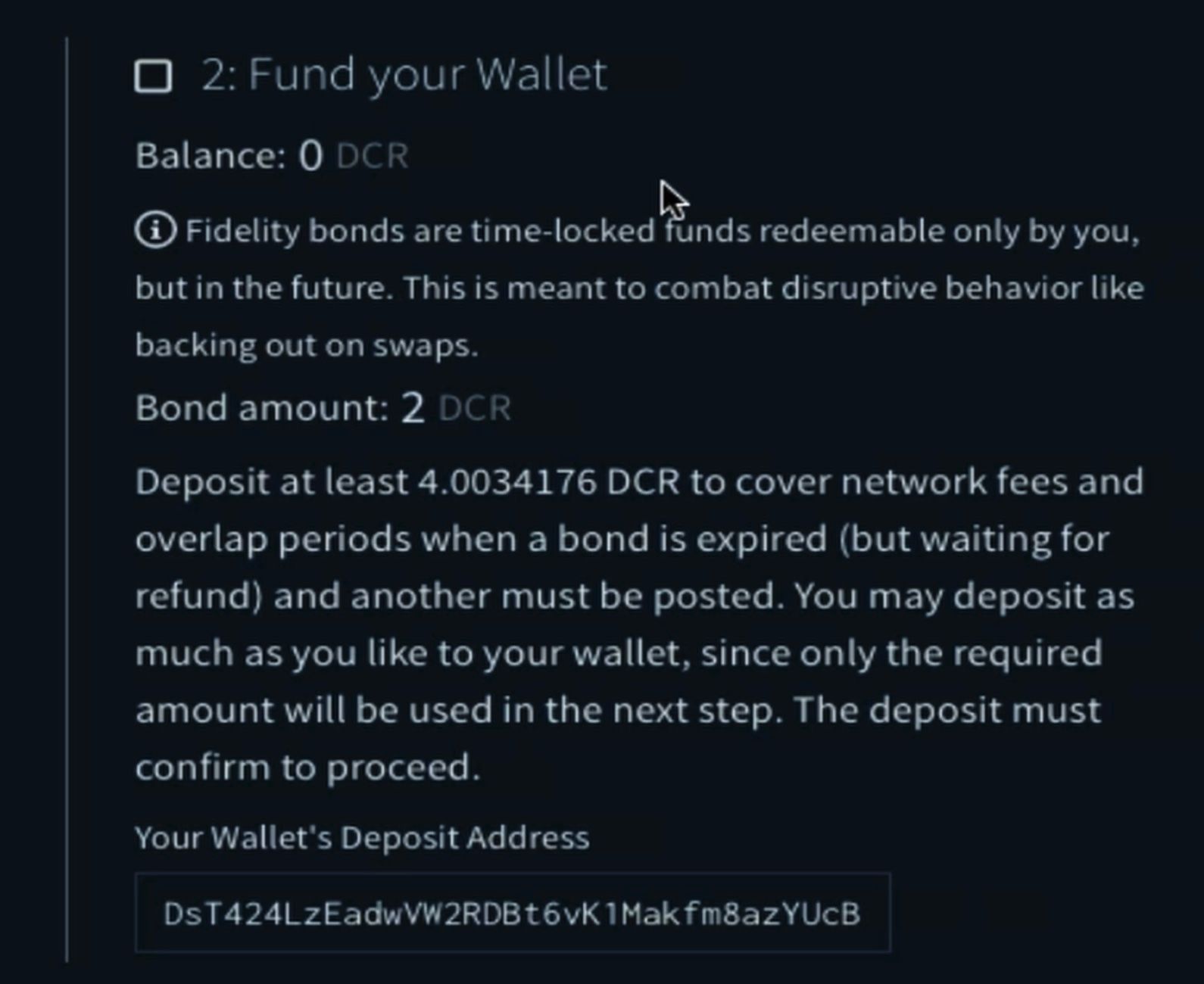

- On setup, the fidelity bond can be paid in the server's preferred asset, currently either DCR and BTC are available. But the eventual goal is to allow the bond to be paid in any available coin.

- To use DCRDEX, you need to lock up 2 bonds. Each bond is locked for approximately 30 days, during the unlocking part of this process, it’s important to start the next locking phase, so you don’t loss access to the platform.

- In Decred terms each bond costs 2dcr which is approximately $30. A total of 4.1 dcr will cover these bonds plus mining fees.

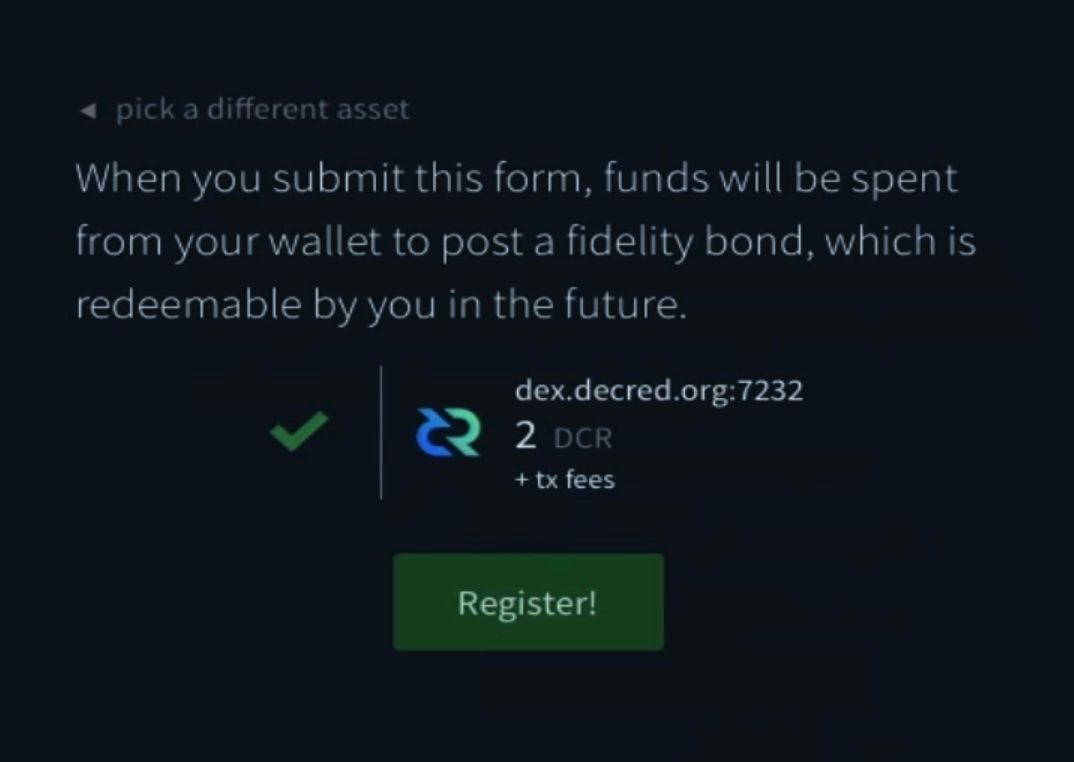

- A bond takes 2 on-chain confirmations to lock and become available, and is then active for approximately 30 days.

- Once you submit your bond and the two confirmations complete, your tier goes from tier 0 to tier 1. Tier 0 meaning you are unable to use the platform and tier 1 meaning you have full access.

- Bonds continuously lock and unlock automatically. No further input is needed from the user after initial setup.

Unlocking the fidelity bond when you want to leave the exchange.

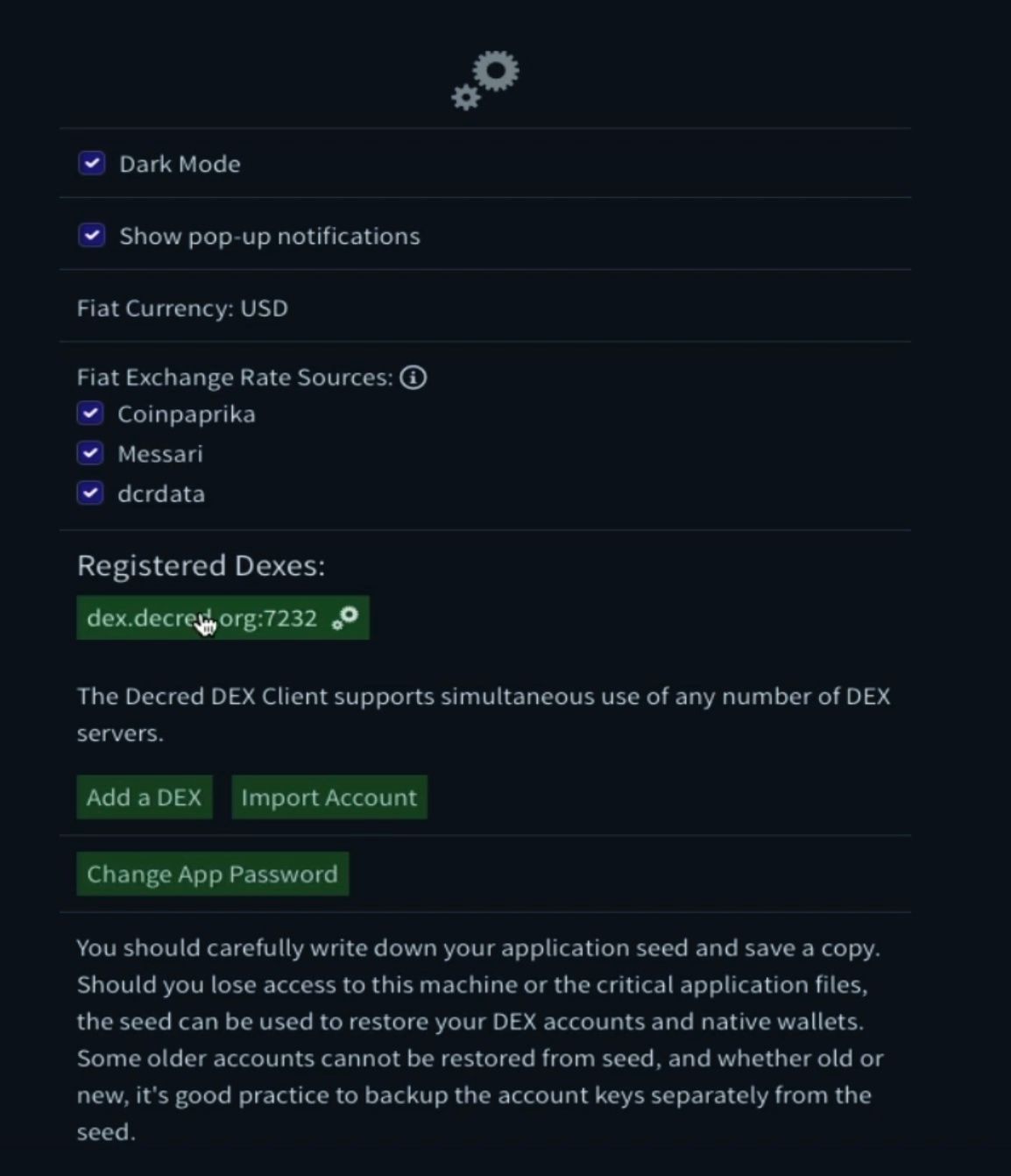

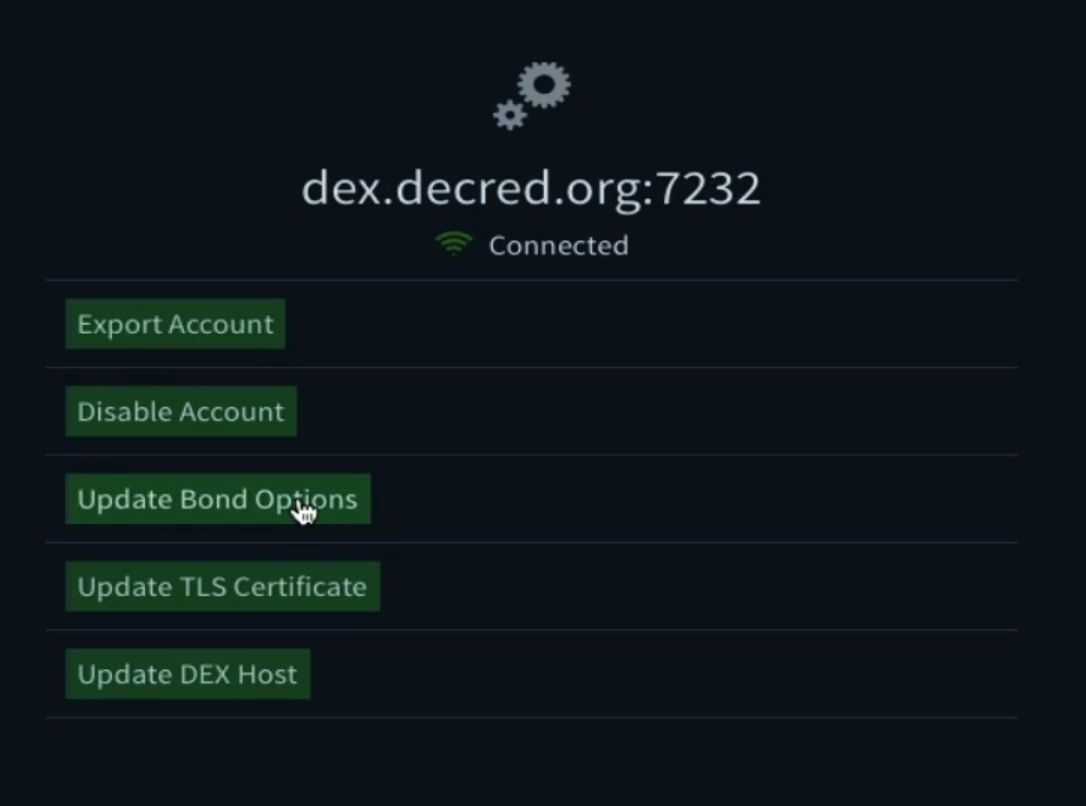

- Go to the hamburger menu (top right)

- Click settings

- Click on the registered DEX button. In my case, dex.decred.org

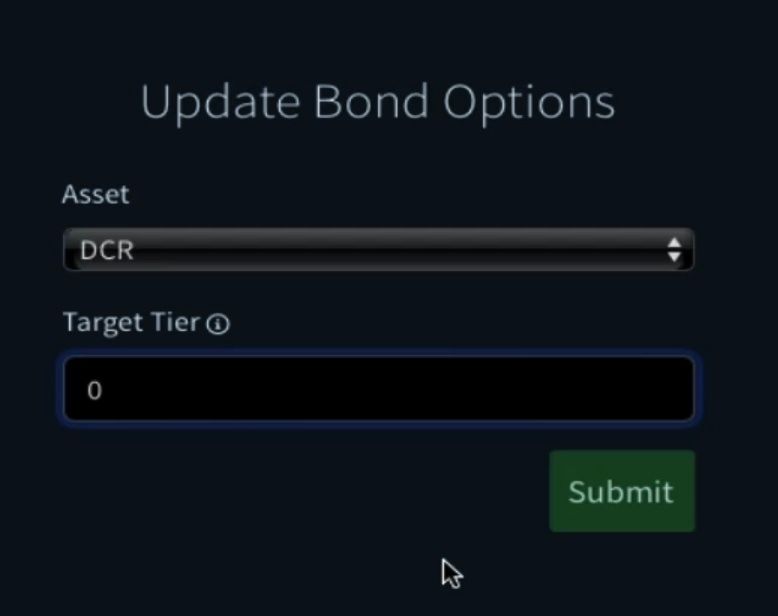

- Click on the “Update bond options”

- On this page, you have two options.

- Change the bond asset

- Change the target tier. If set to 0 (zero) this will cancel the bond.

- After setting the bond to zero, the bond will be returned after a period of time. As said before, this will take approximately 60 days for these funds to become unlocked and available to spend.

With the update from the registration fee to the fidelity bond, DCRDEX is now the first DEX to have no trading fees or discrete value extraction method. Peer to peer exchange is an opportunity to correct the custodial centralised exchange mess that the crypto spaces finds itself in.

Change in culture takes time, but there’s no longer an excuse not to be part of the evolution and get back to the reason the majority of us are here, “peer to peer digital cash with peer to peer exchange”.

Comments ()