Digital Real will be the first official virtual currency of Brazil. It is an extension of the traditional Real, but to be used exclusively in the digital environment.

It will be a new Central Bank Digital Currency (CBDC), meaning that it will be produced and regulated by the Brazilian Central Bank (BC), and follow the current laws of Brazilian monetary policy. By the end of 2024, the Digital Real will be available to the Brazilian public.

The launching of the Digital Real by the Brazilian Central Bank has an objective of lowering costs of bank operations, like the emission of paper currency, focusing on digital consumers. The concept is a mimicry of what happens in the crypto universe, but only a part of it since decentralization is impossible when the state is responsible for the emission. The Central Bank believes that Digital Real will ease access to financial assets with the help of technology.

According to the Central Bank the Digital Real "has the potential to improve the efficiency of the retail payments market and to promote competition and financial inclusion for the population still inadequately served by banking services”.

How will it work?

A great source of inspiration for the Digital Real comes from China, where the Digital Yuan (CNY) is already used in many provinces by more than 260 million people. Access to the Brazilian digital currency will be through a digital wallet, under the responsibility of banks and financial institutions authorized by the Central Bank.

Some of the biggest Brazilian financial institutions presented proposals to participate in the testing phase of the currency, which should start this month. BC has made ten positions available for private sector entities, which will test the new technology in the wholesale/retail segment, and negotiation of National Treasury bonds. There are even Brazilian crypto companies participating, such as Mercado Bitcoin, due to its focus on retail given the platform's experience in trading and distributing tokens and crypto-economic projects. Participants will be chosen according to the technical capacity of the teams in blockchain technology and the knowledge they can bring to the tests.

It is hard to know all the types of services that will emerge from the Digital Real. Fábio Araújo, the coordinator of the initiative, says solutions will come from financial institutions. In this regard, the Digital Real can facilitate, for example, the use of smart contracts, in what is known as "programmable money." Televisions can be programmed to make payments for a movie using digital currency. It will also be possible to automatically pay tolls and parking fees. A Delivery Payment system is already being tested, which would allow, for example, selling a car in exchange for digital currency through software: the program independently verifies if the payment has been received and releases the registration to the counterparty.

Digital Currencies and Cryptocurrencies

Digital currencies and crypto are two forms of digital money with remarking differences. Cryptocurrencies like Decred and Bitcoin have their tokens, which are primarily used for peer-to-peer transactions and investments. They operate on a decentralized blockchain, and are independent of any central authority, creating a new financial system. On the other hand digital currencies are typically issued and regulated by central banks or government entities, designed to function as a digital representation of a country's fiat currency.

Crypto enthusiasts have many complaints regarding digital currencies, such as the lack of privacy, and the dependency on the traditional bank infrastructure. Digital currencies often require information and identification from users. Central Banks and governments are in control of this fiat, being able to monitor transactions and user data. In contrast, Decred believes that privacy is a fundamental aspect of financial transactions. Users can hide their identity by combining tools like the Stakeshuffle protocol, and Atomic Swaps, providing a secure financial ecosystem.

Depending on traditional systems will create as many issues as it solves. This reliance can limit the speed and number of transactions, and total control by a central authority creates the possibility for arbitrary rules and protocols. Decred goes on the opposite path, being the only DAO with:

-Own coin ($DCR)

-Own blockchain

-Own decentralized exchange (DCRDEX)

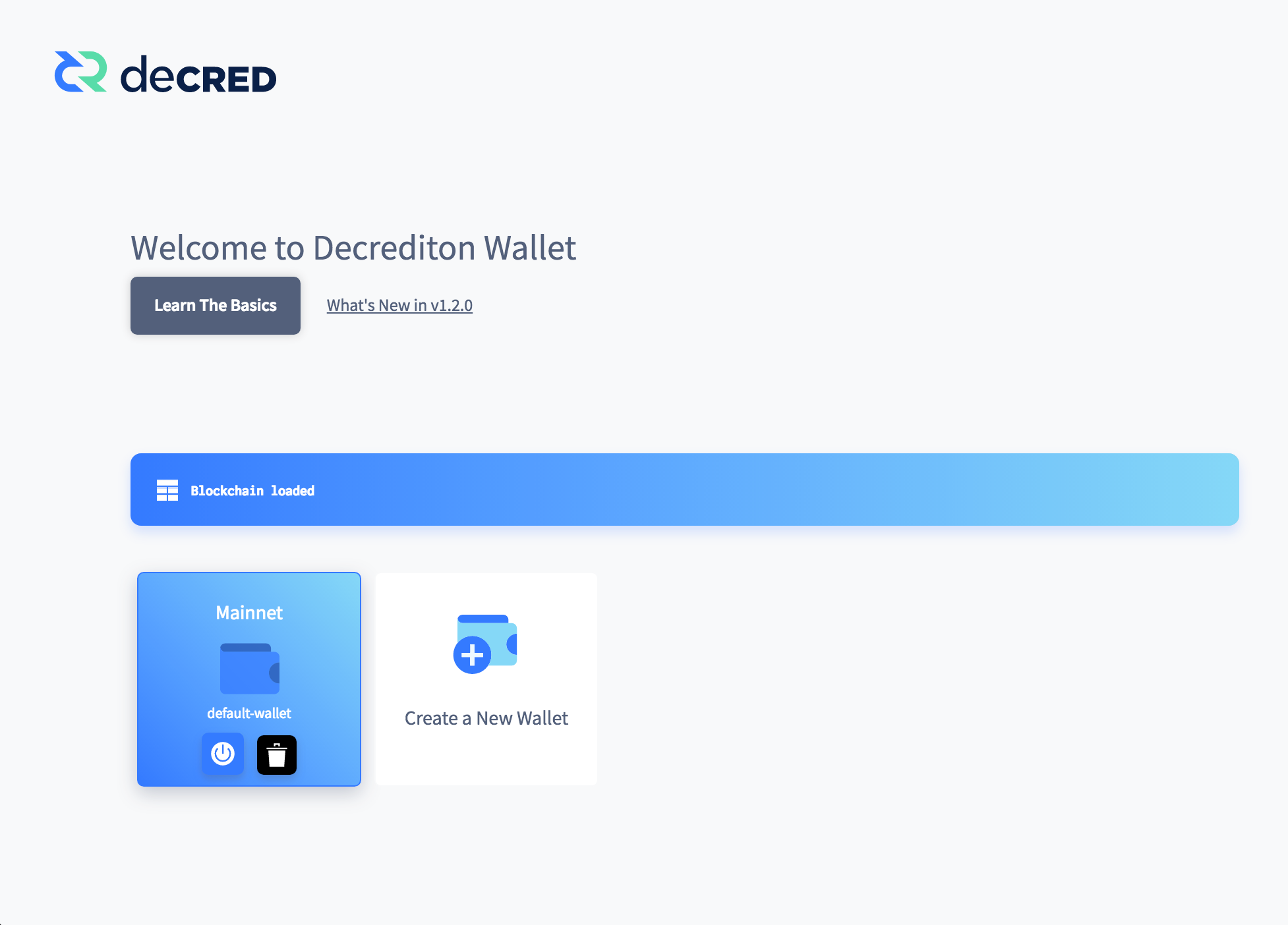

-Own Digital Wallet (Decrediton)

Moving Foward

Cryptocurrencies have gained popularity due to their security tools, decentralized nature, and financial freedom. With the creation of digital currencies by governments and central banks, the crypto projects are likely to adapt and respond with the creation of new applications for their blockchain technology, and even some kind of collaboration with those currencies.

Do you think that the integration between Cryptocurrencies and Digital currencies is a good idea? Leave a comment below!

Comments ()