Blockchain governance - Part 2

In the last decades researchers have been trying to digitally replicate the use and exchange values1 of money, as well as its currency properties: fungibility, scarcity, divisibility, transferability and durability (Menger, 2009).

By Marcelo Martins - September 19, 2020

Part 2: The technology behind the digital money Permalink

In the last decades researchers have been trying to digitally replicate the use and exchange values1 of money, as well as its currency properties: fungibility, scarcity, divisibility, transferability and durability (Menger, 2009).

But money itself must be understood before the introduction of the digital money and blockchains. Menger (2009) defines money as the commodity of commodities because “certain commodities came to be money quite naturally, as the result of economic relationships that were independent of the power of the state. (…) Money is not the product of an agreement on the part of economizing men nor the product of legislative acts. No one invented it. As economizing individuals in social situations became increasingly aware of their economic interest, they everywhere attained the simple knowledge that surrendering less saleable commodities for others of greater saleability brings them substantially closer to the attainment of their specific economic purposes” (Menger, 2007, p. 262). Without money, “specialization of function and division of labor could not go very far if we had to continue to rely on the barter of product for product. In consequence, money has been introduced as a means of facilitating exchange, and of enabling the acts of purchase and of sale to be separated into two parts” (Friedman, 2002, p. 14).

When it comes to currency, the medium of exchange, Hayek points that “the genuineness of metallic money could be ascertained only by a difficult process of assaying, for which the ordinary person had neither the skill nor the equipment, a strong case could be made for guaranteeing the fineness of the coins by the stamp of some generally recognised authority which, outside the great commercial centres, could be only the government”. Then Hayek reaches the problem of power imbalance when he argues that “it is evident that, as coinage spread, governments everywhere soon discovered that the exclusive right of coinage was a most important instrument of power as well as an attractive source of gain (…) at least so long as people had no alternative but to use the money they provided. During the Middle Ages, however, the superstition arose that it was the act of government that conferred the value upon the money” (Hayek, 1990, pp. 29, 30).

In 1976, Hayek foresaw the creation of private money: “the question at once arises whether it would not be equally desirable to do away altogether with the monopoly of government supplying money and to allow private enterprise to supply the public with other media of exchange it may prefer.” (Hayek, 1990, p. 26).

The chain of blocks Permalink

The blockchain is a distributed ledger used to securely store transactions in a network of participating nodes, transparent to every node. Consensus rules validate the transactions before they are added to the blocks, which are secured by a distributed timestamp server proving their existence and reinforcing the ones before them (Nakamoto, 2008).

A transaction is a chain of digital signatures2. Digital signatures depend on a pair of keys for each owner. The owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner. New transactions are broadcast to all nodes, then collected into blocks. To avoid double-spend attempts, the earliest transaction is the one that counts, otherwise a trusted central authority would be necessary (Nakamoto, 2008).

Blockchain and proof-of-work security Permalink

With Bitcoin everyone can be in control of their own money, not the trusted third party. To stay in control, the user must keep the coins in their ‘wallet’. The ‘wallet’ is a reference to the pair of keys previously introduced, specifically the private key, the one that signs the transactions and must be kept secret. The private key is usually referred as the ‘seed’3, a set of mnemonic words where each one represents part of the key. If the user leaves their coins in an exchange platform, a broker, they might go bankrupt or just vanish with the user’s money (Narayanan, Bonneau, Felten, Miller, & Goldfeder, 2016).

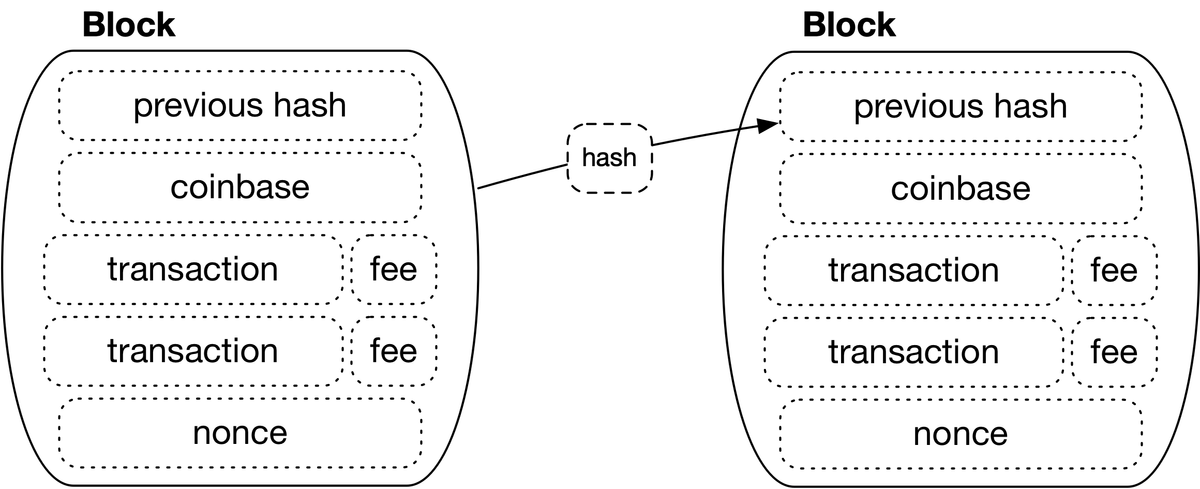

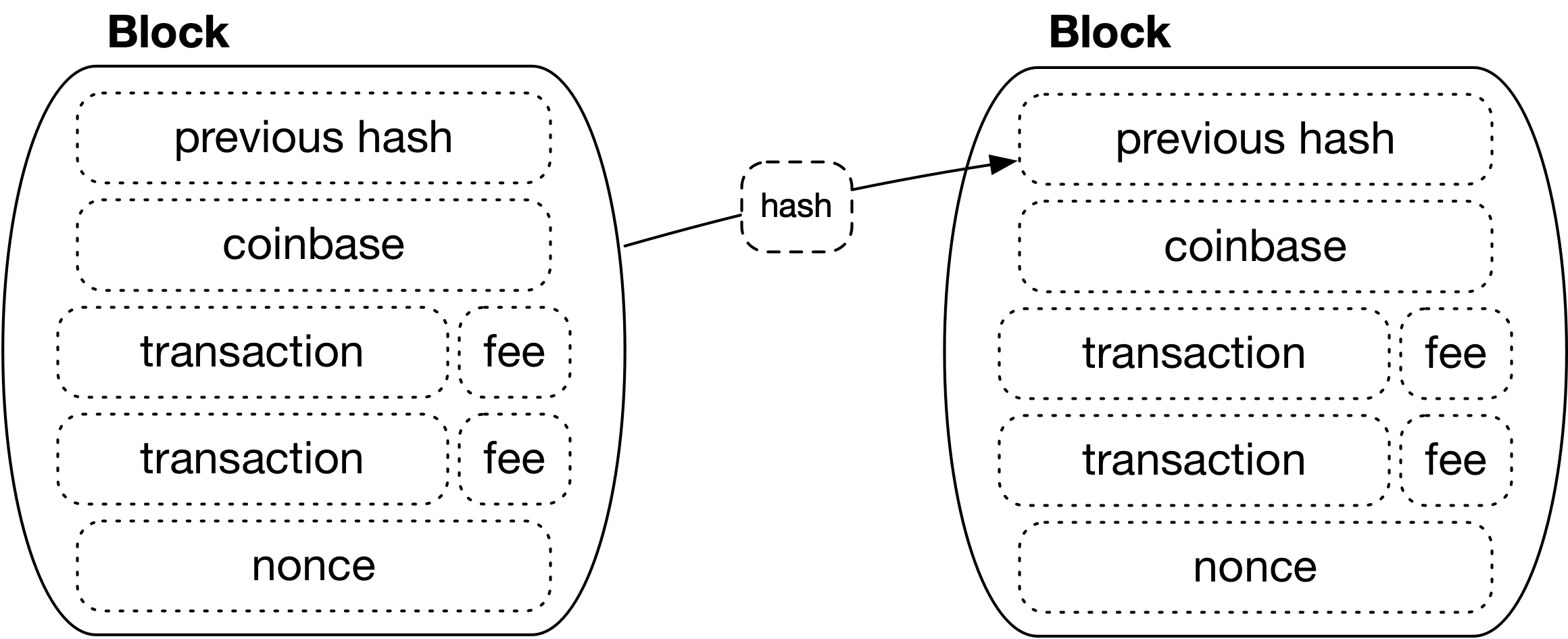

Proof-of-Work maintains blockchain security by creating a hash of the previous block and inserting it into the next. For a hash to be valid it must have a number of leading binary zeroes predetermined by the algorithm. If the hash is invalid, the miner increases the ‘nonce’, ‘number used only once’, and tries again. The more leading zeroes the algorithm requires, the harder it is. Figure 1 shows how the blocks are connected creating a blockchain.

Figure 1 – Proof-of-Work-based blockchain

Source: own elaboration

Proof-of-work is essentially one-CPU-one-vote. The longest chain has the greatest proof-of-work effort invested in it, representing the decision of the majority. As long as the majority of CPU power is controlled by honest nodes, the honest chain will be the longest one, surpassing other chains. The longer the chain the more secure the previous blocks become, because exponential work would be necessary to recreate the chain from the point where an adversary wants to make an arbitrary change, catch up and surpass the honest chain.

Miners may pull resources together and coopete, cooperating in a pool of miners and competing with other pools to find the hash that validates the block. The incentives are shared in the pool according to the processing capacity of each miner (Eyal, The Miner’s Dilemma, 2015).

Open source software also contributes a great measure to security, transparency, auditability, replication of code and interoperability.

Incentives and inflation Permalink

Mineable cryptocurrencies create money by issuing new coins. The first entry in the block is called ‘coinbase’ and it creates and sends the coins to an address chosen by the miner. This reward is the incentive for the work on the block, spending electricity on the processing and wearing out the machines. To compensate increases in hardware power and new miners joining the competition, difficulty is adjusted by a moving average targeting an average number of blocks per hour. Machines lose their usefulness more quickly when difficulty increases leading to a competition in terms of fixed costs (space rent and cost of machines and cooling equipment) and efficiency of the machines (cost of electricity per billions of hashes per second and cooling equipment).

The incentives can also be funded with transaction fees because the user signing the transaction decides if the miner will get a fee for the processing work. On the other hand, the miner includes in his block the transactions with higher fees because he wants to maximise his profit. The fees are important to select which transactions will be mined and to reduce transaction spam.

Inflation in a blockchain is limited to the creation of new coins and is a predictable process managed by the consensus rules of the network. Coin price reflects the expectation the participants have about the utility of the network and the creation of new money. For Hayek, the imperfect gold standard “had three very important advantages: it created in effect an international currency without submitting national monetary policy to the decisions of an international authority; it made monetary policy in a great measure automatic and thereby predictable; and the changes in the supply of basic money which its mechanism secured were on the whole in the right direction” (Hayek, 2009, p. 41). So, gold had no governance issues, was predictable and its production was stimulated or discouraged according to its value. It is also true for mineable cryptocurrencies.

The source of money has been a problem for a very long time. In 1983, Margaret Thatcher made a warning that hit a great part of the problem. She said: “Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more” (Thatcher, 1983). But Ms Thatcher did not mention that the government may also create new money out of thin air, the ‘Quantitative Easing’, because it controls the supply of money (Bank of England, 2019). Friedman explained the difference in his key propositions of monetarism. He wrote that “Government spending may or may not be inflationary. It clearly will be inflationary if it is financed by creating money, that is, by printing currency or creating bank deposits”, not the case of borrowing or taxation (Friedman & Goodhart, 2003, p. 86). It means that the creation of new money devalues the currency, and this is the reason for being one of the most important consensus rules and the basis of the risk-reward Proof-of-Work (PoW) mining.

Hayek also flagged the control of money supply when he wrote that “a money deliberately controlled in supply by an agency whose self-interest forced it to satisfy the wishes of the users might be the best. A money regulated to satisfy the demands of group interests is bound to be the worst possible. (…) The government monopoly of the issue of money was bad enough so long as metallic money predominated. But it became an unrelieved calamity since paper money (or other token money), which can provide the best and the worst money, came under political control” (Hayek, 1990, p. 31).

When it comes to paper money, the fiat currency becomes a technical monopoly. Competition will not provide an effective limit because the private issuer wants to issue more currency until the market value of the additional currency equals the cost of the paper where it is printed. The government tasks then are to set an external limit to the amount of money and to prevent counterfeiting (Friedman, 1960).

But there is the agency problem, that appears on Hayek’s argument: “There is no reason to doubt that private enterprise would, if permitted, have been capable of providing as good and at least as trustworthy coins.” But, “since the function of government in issuing money is no longer one of merely certifying the weight and fineness of a certain piece of metal, but involves a deliberate determination of the quantity of money to be issued, governments have become wholly inadequate for the task and, it can be said without qualifications, have incessantly and everywhere abused their trust to defraud the people” (Hayek, 1990, pp. 25, 30).

Put this way, to provide ‘good and trustworthy coins’ that satisfy the wishes of its users, issued in a predictable manner and according to its value, the private enterprise needs good governance, that comes with good consensus rules for money issuance and payment processing, topic that will be connected in the following sections.

Footnotes Permalink

1 Menger explains that “Use value, therefore, is the importance that goods acquire for us because they directly assure us the satisfaction of needs that would not be provided for if we did not have the goods at our command. Exchange value is the importance that goods acquire for us because their possession assures the same result indirectly.” (Menger, 2007)

2 A brief notion of cryptography: https://stakey.club/en/a-brief-notion-of-cryptography/.

3 PGP word list: https://en.wikipedia.org/wiki/PGP_word_list.

References Permalink

Eyal, I. (2015, July 20). The Miner’s Dilemma. 2015 IEEE Symposium on Security and Privacy (pp. 89-103). San Jose, CA: IEEE. Retrieved from https://ieeexplore.ieee.org/abstract/document/7163020

Friedman, M. (1960). A Program for Monetary Stability. Fordham.

Friedman, M. (2002). Capitalism and Freedom. The University of Chicago Press.

Friedman, M., & Goodhart, C. A. (2003). Money, Inflation and the Constitutional Position of the Central Bank. Retrieved from Institute of Economic Affairs: https://iea.org.uk/publications/research/money-inflation-and-the-constitutional-position-of-central-bank

Hayek, F. A. (1990). Denationalisation of money: The argument refined (3rd ed.). The Institute of Economic Affairs. Retrieved from Ludwig von Mises Institute: https://mises.org/library/denationalisation-money-argument-refined

Hayek, F. A. (2009). A Commodity Reserve Currency. In F. A. Hayek, A Tiger by the Tail (pp. 41-43). The Institute of Economic Affairs and the Ludwig von Mises Institute. Retrieved from A Tiger by the Tail: https://iea.org.uk/publications/research/a-tiger-by-the-tail-the-keynesian-legacy-of-inflation

Menger, C. (2007). Principles of Economics (5th ed.). (J. Dingwall, & B. F. Hoselitz, Trans.) Vienna, Austria: Ludwig von Mises Institute. Retrieved from Ludwig von Mises Institute: https://mises.org/library/principles-economics

Menger, C. (2009, November 17). On the Origins of Money. Ludwig von Mises Institute. Retrieved from Ludwig von Mises Institute: https://mises.org/library/origins-money-0

Nakamoto, S. (2008, October 31). Bitcoin: A peer-to-peer electronic cash system. Retrieved from Nakamoto Institute: https://nakamotoinstitute.org/bitcoin/

Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction. Princeton, Oxford, USA, UK: Princeton University Press.

Comments ()